AMC Entertainment (NYSE: AMC) announced this past Wednesday that 98% of its US locations would be re-opened by Friday March 26th, including the lucrative Southern California markets, where the company operates 54 theatres with 726 screens. The re-opening news sustained an unlikely rally in AMC’s equity that really got going following the release of an abysmal 2020 year end earnings this past Friday.

If ever there was a year end financials to be buried after market on a Friday, it was this one. AMC is lucky the censors didn’t hit them with an obscenity charge.

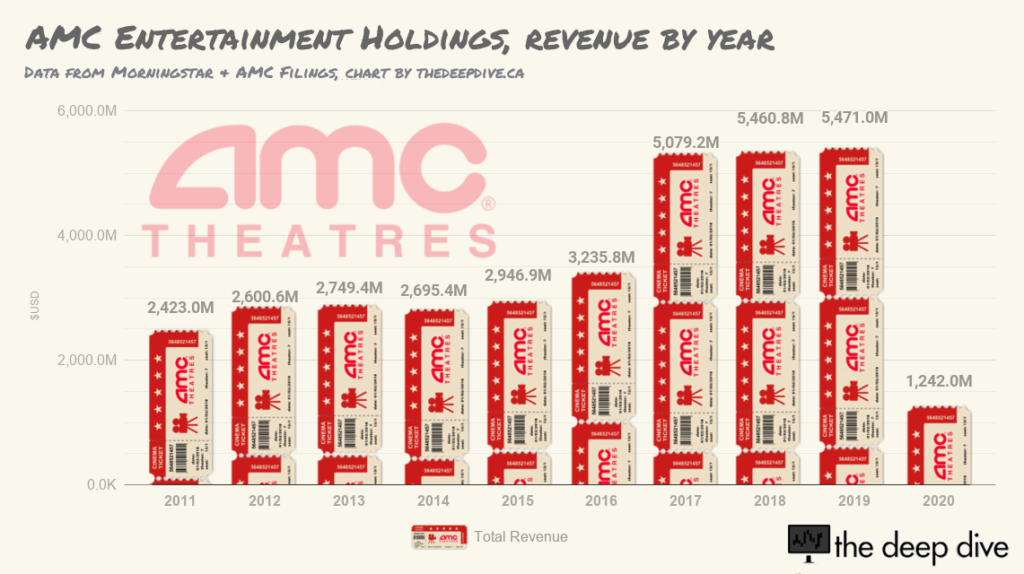

Top line revenue fell out of its respectable three year plateau between $5 billion and $5.4 billion to a paltry $1.2 billion.

Without even including -$2.5 billion in impairments, AMC posted an operating loss of -$1.6 billion. It generated -$1.12 billion in cashflow (vs. $579 million in 2019), and remained on the hook for about half its operating costs ($856 million vs. $1.68 billion in 2019), despite generating 22% of the revenue.

Prior to climbing aboard the 2020 roller coaster, AMC Theaters was a debt-financed business that put its cash-flow on the bottom line for the shareholders. It paid a $0.20 quarterly dividend like clockwork, and kept the cap table tight. The floor falling out from under the revenue forced a drastic change in strategy that saw the company’s cap table ballooning from 110 million outstanding shares in September 2020 to 450 million shares today, and erased the prospect of near-term dividends completely.

In a market where equity valuations were reflections of the strength of their underlying businesses, a financial beating of that magnitude would have put AMC Theatres’ stock price in the tank. Yet…

AMC Theatres of the absurd

The stock market is a forward-looking mechanism. As the investors interested in the cash return from the dividend wrote AMC Theatres off as a glorified snack bar, the company has found support among traders who see its potential for growth.

How and why AMC became an unlikely market darling in what everyone hopes is the beginning of a re-opening is a bit more complicated, and a lot more interesting, so stay tuned to The Dive for an AMC Theatres sequel, where we’ll cover how the company convinced the market to suspend its disbelief, buy the ticket, and take the ride.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

China communist party owns this company. Don’t support this cinema company.

Do your research clown

You might want to mention that earnings dont matter at all during a pandemic when theatres were closed, and that there are a slew of spring / summer blockbusters coming out – Top Gun, Mortal Kombat and Kong vs Gozilla to name a few. Also their private theatre rentals are taking off. You also didnt mention they are the worlds largest theatre company, or that they raised a billion dollars during the GME squeeze. Also, you didn’t mention how they were a 40 dollar stock before the pandemic and IPO was 18 in 2013. Ans you didnt mention the pent up demand moviegoers have to go out since being locked up for months. BC loves AMC, Canada loves AMC, Euros love AMC, Saudis too, but AMERICANS LOVE AMC MOST!

Thanks for reading.

There is quite a lot that went un-mentioned, because when these things get too long, people don’t read them. Part 2, coming soon, mentions a whole lot more, including a few good reasons AMC might be able to stay on top.

-B