The latest tea in the APE community has seen YouTube stock and crypto vlogger Matt Kohrs clobbered on Twitter after his recent post did not sit well with AMC Entertainment Holdings, Inc. (NYSE: AMC) investors.

Pertaining to the recently announced brand new securities class AMC Preferred Equity or APE, Kohrs asked if it was “smarter to sell all APE and double down on AMC [shares]” instead.

P.S. This would also mean that retail owns a larger % of #AMC float

— Matt Kohrs (🦍,🦍) (@matt_kohrs) August 8, 2022

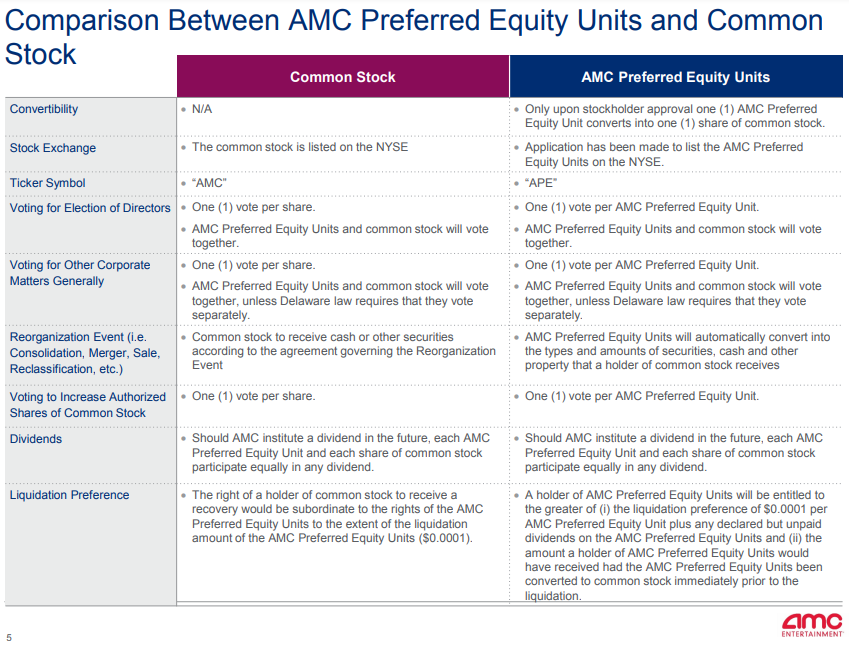

The question comes from the nature of the new security: APE will be distributed like a dividend where each share held of the 516,826,595 AMC shares will get one APE. CEO Adam Aron emphasized that this move, while functioning like a 2-for-1 split, will not result in dilution since “new APEs all go and only go to holders of company issued AMC common shares.”

However, since the APEs will also trade on the New York Stock Exchange under the symbol “APE” and is authorized for 5 billion units, the class can still be subject for dilution. Aron himself said that the equity will provide the firm “a currency that can be used in the future to further strengthen [its] balance sheet.”

This compares to the AMC common stock which has reached the maximum authorized number of shares, and was rejected by the shareholders to increase number of shares amid fears of dilution.

Well, he did ask if he was missing something. So, Twitter users were quick to point it out.

Tell me you don’t understand APE without telling me you don’t understand APE

— Colin (@colin_gladman) August 8, 2022

Matt everyone is looking at this with their heart ❤️ and not with their eyes 👀 we about to get focked by AA #amc is about to be cut in half and ape shares about to be diluted

— chakka-kong (@ECHACKA) August 9, 2022

The nature of your question is a red flag 🚩 that you either don’t understand what is going on here or you have ulterior motives. I could be wrong, that’s but that’s my honest reaction.

— Retail Investor 📉📈 (@RTLINVEST) August 8, 2022

Why would you sell APE shares so that the shorts can get there hands on them? Yea, you are missing alot— put them in their hands, they can vote to convert them to AMC shares, and use them to cover

— andrew francese (@kskye327) August 8, 2022

If he is only releasing as many shares as the float. Who's to say everyone just holds? No one should be able to buy APE if no one is selling. Why would anyone sell?

— Ish (@sugarloaf007) August 7, 2022

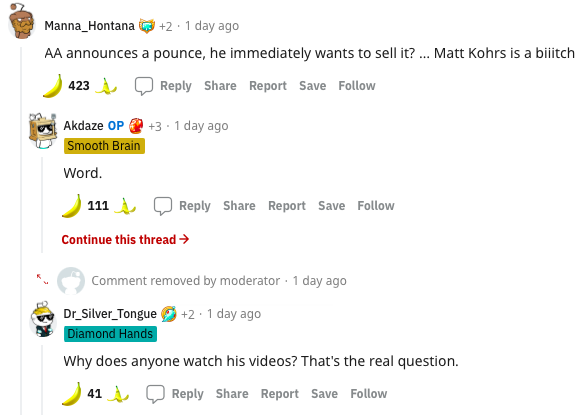

The discussion even spilled on to Reddit.

However, he wasn’t alone in his thoughts.

It’s a fair question and I’m suprised more people aren’t asking this. The fact anyone is attacked for simply asking “why” shows our community really is starting to divide in a way I hate. The point of our movement from the very beginning was WE CAN DO WHAT WE WANT WITH OUR MONEY

— AMC Strong! (@Timmy90715557) August 11, 2022

See false info being spread! Face it folks the AMC board is trying to circumvent it’s shareholders wishes. Now we gotta buy and hold APE too? What a racket Wall Street is. pic.twitter.com/edmUR4IFe6

— EAT_THE_RICH (@EATTHER69114217) August 9, 2022

In the end, it seems like the vlogger did just want to “entertain.”

— Matt Kohrs (🦍,🦍) (@matt_kohrs) August 11, 2022

AMC Entertainment last traded at US$25.02 on the NYSE.

Information for this briefing was found via Twitter and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.