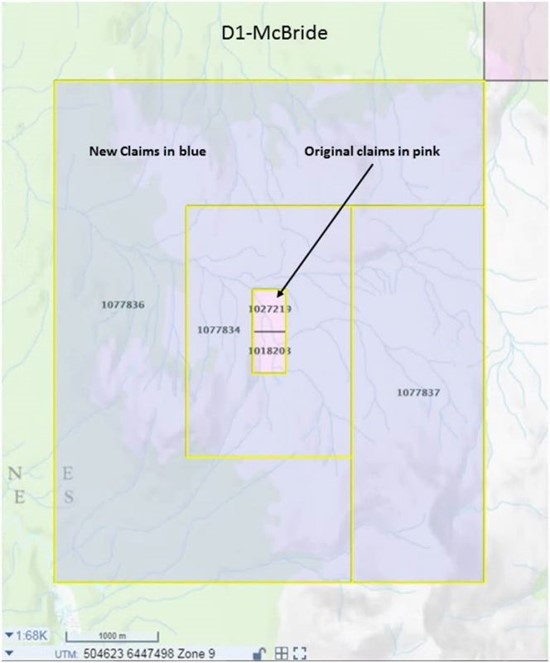

American Creek Resources (TSXV: AMK) this morning announced that it has significant expanded its D1-McBride property located in BC Golden Triangle. And quite frankly, that somehow appears to be an understatement. The original property, at 34 hectares in size, has been expanded by approximately 2,600 hectares.

The new land holding is adjacent to and surrounds the original D1-McBride property held by American Creek, with the entire property now being subject to 100% ownership by the firm. The property as a whole is located in the northeast corner of the golden triangle in BC, 64 kilometres southeast of Dease Lake and 60 kilometres northeast of the Red Chris mine.

Evidently the land itself is relatively untouched in terms of exploration. Rock sampling conducted in 2014 on the new claims area returned high grade assays of 43.1 g/t gold, 240 g/t silver, 1.8% lead, and 1.98% zinc from a vein subcrop in what is referred to as the Discovery Showing. Veins have been traced for over 30 meters on surface via prospecting and trenching, however it appears no prior drilling has occurred on the property.

The acquisition of the additional claims at the property now makes D1-McBride the largest property held by American Creek. The expanded claims cover the projected trace of the exposed veining system, as well as the fault system that is believed to be related to the veins as well as regional faults.

Acquisition costs for the expanded property were not provided.

American Creek Resources last traded at $0.40 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned above. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.