On December 6th, Equinox Gold (TSX: EQX) announced that it sold an aggregate of 11 million shares of Solaris Resources (TSX: SLS) for gross proceeds of C$70.4 million. They add that this was done “in the ordinary course for investment purposes through the facilities of the Toronto Stock Exchange through block trades.”

Equinox stated it remained a supportive shareholder of the company and agreed to not sell any of its remaining Solaris securities for 120 days. After the selling, they continue to own 15.6M common shares and 7.5 million warrants, putting their ownership in the company on a partially diluted basis at 17.9%.

Equinox Gold currently has 12 analysts covering the stock with an average 12-month price target of C$5.80 or an upside of 15%. Out of the 12 analysts, one has a strong buy rating, five have buy ratings, another five have hold ratings, and the last analyst has a sell rating on the stock. The street-high price target is C$9, representing an upside of almost 80%.

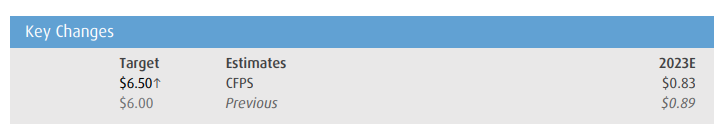

After the news, BMO Capital Markets raised their 12-month price target on Equinox to C$6.50 while reiterating their outperform rating. They say that the divestment does not surprise them “given the large amount of capital currently being deployed at Greenstone.”

BMO had previously expected Equinox to improve its liquidity position using its own equity as it expected the company to do a $250 million equity raise. Equinox recently announced the introduction of a $100 million at-the-market program. With the news of the sale, BMO now only expects that the company will utilize the $100 million ATM, and the dilution will be less costly to the increased share price.

Even with the $70.4 million new cash, BMO still believes that Equinox will still be in breach of its leverage ratio covenants at year-end. BMO does expect that Equinox’s leverage will improve as Greenstone Capex slows down and the mine ramps up in 2024. This does not account for additional share sales and/or the use of the ATM to help improve the ratio.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.