Before the market opened on July 21, American Express Company’s (NYSE: AXP) reported its second quarter 2023 results. Earnings per share (EPS) exceeded analysts’ expectations for the fifth successive quarter, but 2Q 2023 revenue fell short of estimates for the first time over that period.

Specifically, the company reported 2Q 2023 EPS of US$2.89 (a record for any quarter) versus US$2.57 a year ago and the analysts’ consensus 2Q 2023 estimate of US$2.81. AXP’s 2Q 2023 revenue was US$15.1 billion in 2Q 2023, US$0.3 billion shy of 2Q 2023 projections, but still notably higher than US$13.4 billion in 2Q 2022.

Despite the impressive earnings results, five details in the quarter can be considered troubling, and these factors are likely behind the stock’s decline of 3.5% on July 21.

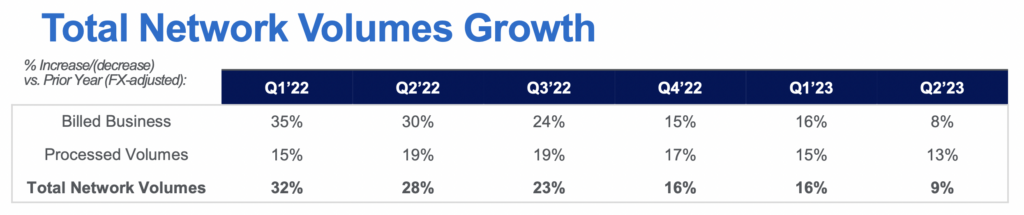

- AXP’s total network volume growth increased 8% year-over-year (YOY) in 2Q 2023, admittedly a solid gain, but this represented a marked reduction versus 14% and 12% in 1Q 2023 and 4Q 2022, respectively. Even after factoring out foreign exchange (FX) fluctuations, adjusted 2Q 2023 volume growth of 9% was much slower than the 16% realized in each of the previous two quarters.

Of course, the question which springs from the data is whether this is an early sign that consumer spending is slowing down, especially given the relative affluence of AXP’s card user base.

- A particularly surprising aspect of AXP’s network spending data was the modest spending growth by U.S. small and medium sized businesses (US SMEs). Spending by those entities, which comprise 25% of AXP’s total network spending, rose just 2% YOY in 2Q 2023.

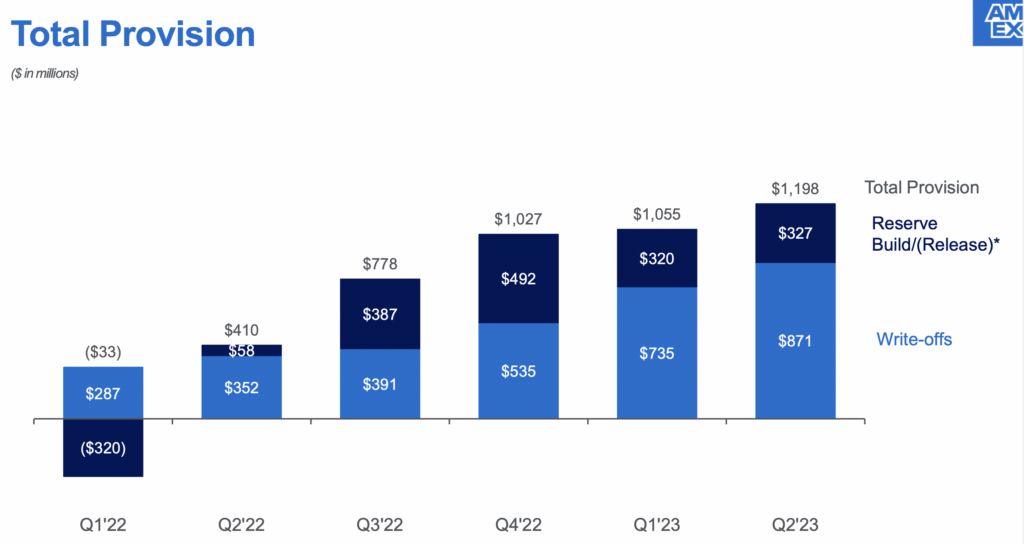

- AXP set aside US$1.2 billion for credit losses in 2Q 2023, marking the third consecutive quarter of provisions exceeding US$1 billion. In 2Q 2022, the provision for credit losses was only US$410 million.

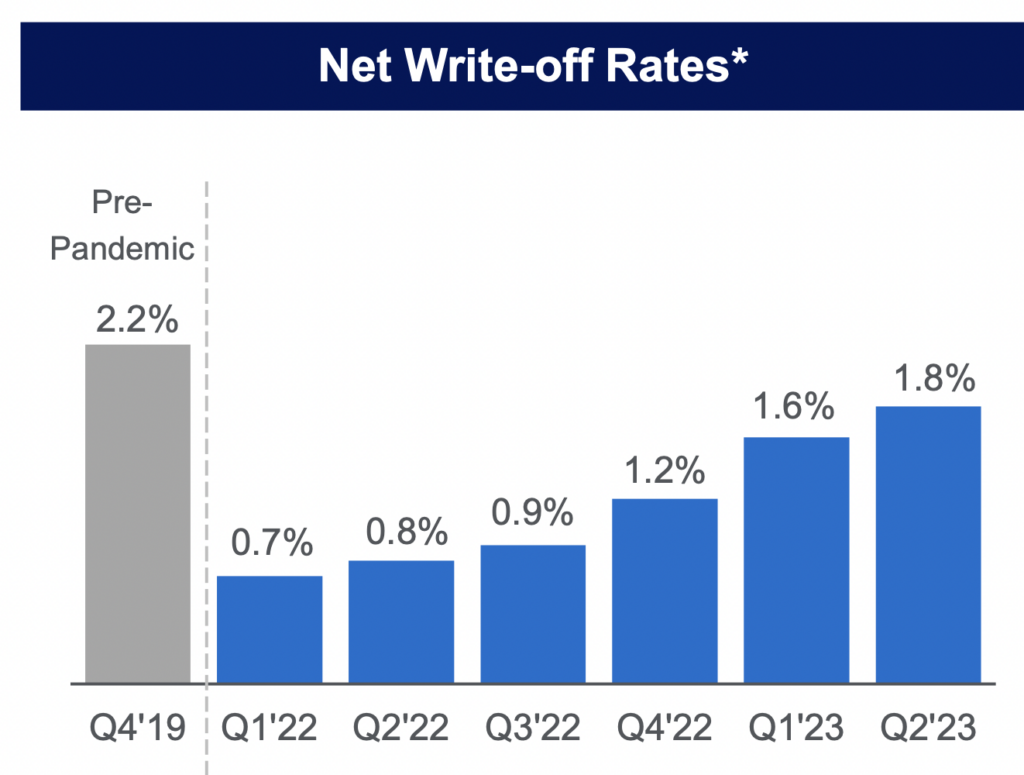

- AXP’s charge-off rates on members’ credit cards continued to increase, reaching 1.8% in 2Q 2023, up from only 0.8% in 2Q 2022. Still, the 2Q 2023 charge-off rate was lower than 2.2% in 4Q 2019, the last full quarter before the COVID pandemic hit.

- Despite reporting a record quarterly EPS in 2Q 2023, AXP did not raise its full-year 2023 EPS guidance. The company affirmed the US$11.00 to US$11.40 guidance it issued in January 2023.

American Express Company last traded at US$170.85 on the NYSE.

Information for this story was found via Edgar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.