America’s economy is falling behind. US productivity fell by the most on record in the last quarter while labour costs continued to accelerate, suggesting that inflation may be here to stay for awhile longer.

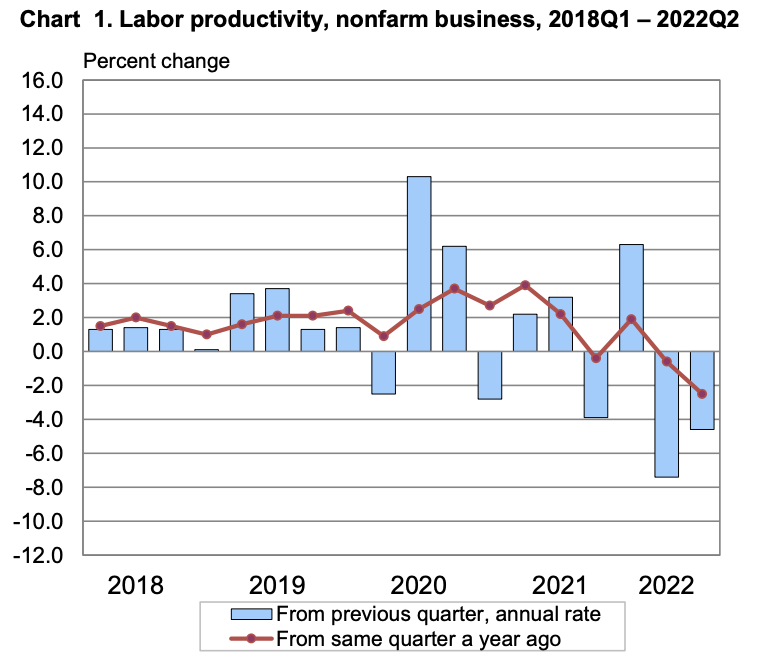

Nonfarm business employee output per hour, which defacto measures the level of productivity in the economy, fell by an annualized 4.6% in the second quarter of 2022, following a drop of 7.4% in the first three months of the year. The latest figures mark the lowest consecutive readings on Labour Department records dating back to 1947, and when compared on a year-over-year basis, hourly output plummeted by the most on record.

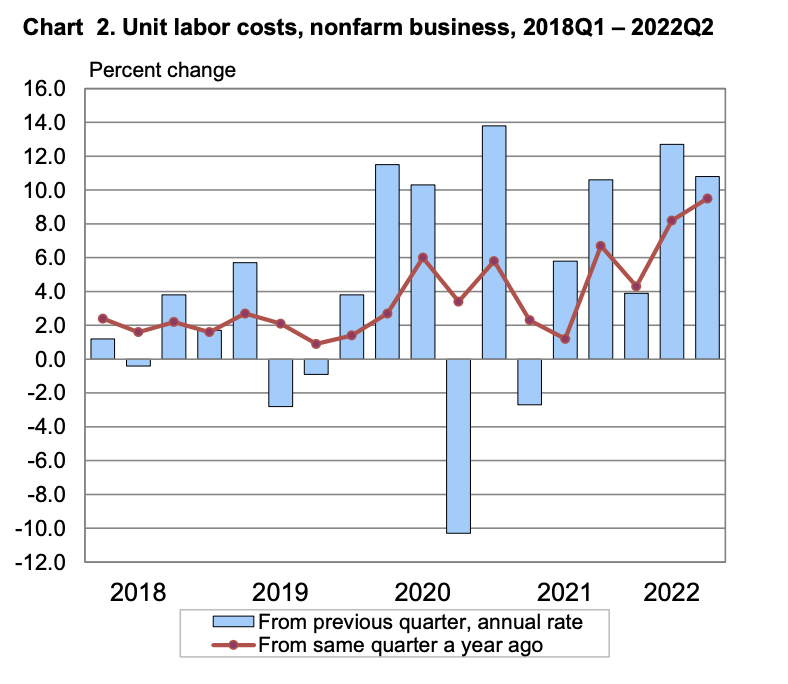

While productivity is on the decline, unit labour costs rose 10.8% between the first and second quarter, and when compared on an annual basis, rose by the most since 1982. With labour costs becoming one of the biggest expenses for employers, companies are increasingly upgrading to new technologies and equipment to boost output while avoiding the inflationary pressure of rising wages.

However, labour costs continue to surpass the Fed’s inflation target by almost five times the annual basis, meaning the ongoing upwards push on consumer prices will make the central bank’s hawkish monetary policy efforts less impactful. “Declines of this magnitude are not sustainable— scorching labor costs will eventually lead to hiring freezes and outright layoffs unless there is a strong growth rebound. Increased recession odds suggest the former is more likely than the latter.” Bloomberg economists Yelena Shulyatyeva and Eliza Winger said.

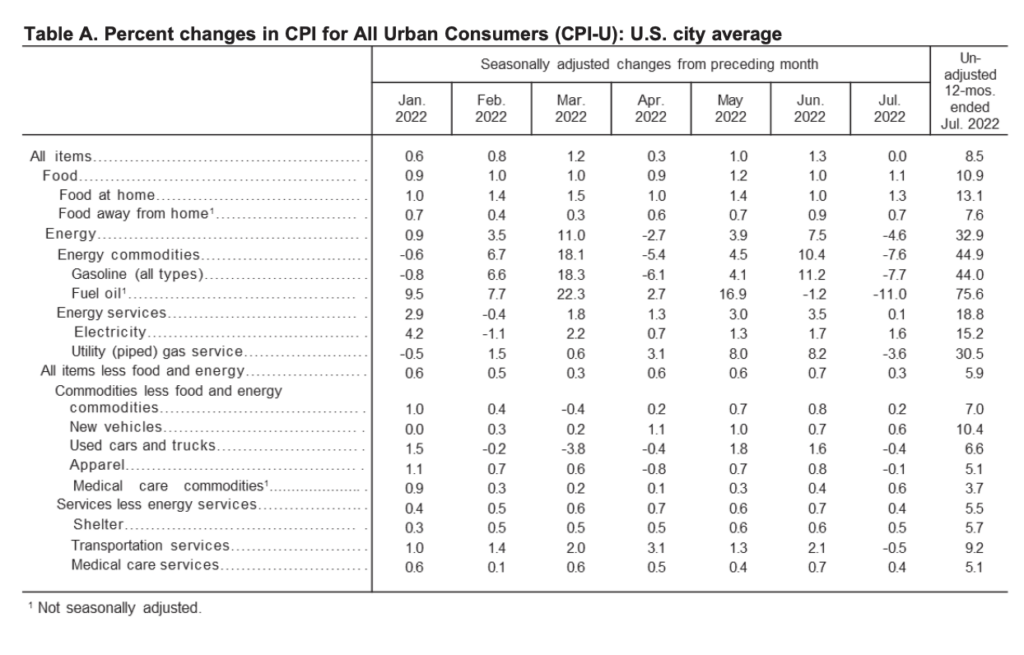

The US unemployment rate fell to 3.5% in July, the lowest in nearly 50 years, with job openings exceeding the unemployed by almost two-to-one. With businesses forced to compete for employees, hourly compensation has been sent soaring, albeit not enough to keep up with inflation. Indeed, Labour Department data published on Wednesday showed that consumer prices finally stagnated in July, but were still 8.5% higher compared to last year. However, core CPI, which strips out food and energy, rose 5.9%, suggesting that price pressures remain rampant across the economy.

Information for this briefing was found via the BLS and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.