Aphria Inc (TSX: APHA) (NASDAQ: APHA) will be releasing their second-quarter fiscal 2021 financial results this week on January 14th before market open.

Currently, Aphria has 11 analysts covering the company with a weighted 12-month price target of C$10.85. This is up from the average at the start of the month, which was C$9.96. Two analysts have strong buys, while another six have buy ratings, and three analysts have hold ratings.

Canaccord has released their quarterly earnings preview for the firm. In the note, they maintained their C$11 12-month price target and hold rating on the company. Matt Bottomley headlines, “Expecting APHA to print incremental improvements and maintain leading Cdn position.”

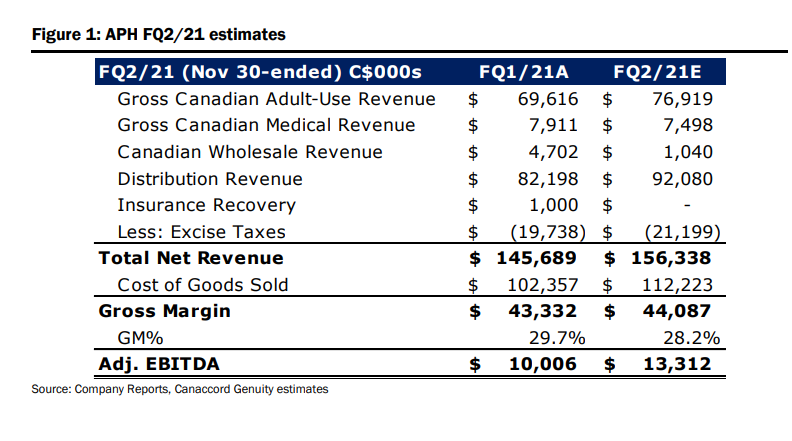

Canaccord expects total revenue to come in at C$156.3 million and EBITDA to be C$13.3 million for the second quarter. Bottomley expects this quarter to be a rebound from their miss in expectations for the first quarter. He writes, “However, for the quarter, we expect the company to see continued growth in its Cdn penetration as the company looks to maintain its #1 market position in the Cdn recreational market.” He believes that the Tilray merger and the acquisition of SweetWater will likely be the talking points for management during the conference call.

Bottomley expects recreational revenue to come in at C$76.9 million, or a 7.3% increase quarter over quarter. Aphria currently holds the #1 market share in the recreational space.

In terms of medical revenues, Bottomley comments, “seemingly fewer patients [are] booking appointments to renew their prescriptions on the back of COVID-19.” Canaccord as a result has forecasted that medical cannabis revenue will decline 5% to C$7.5 million, as their expectation is that the medical market has not grown but rather gone stagnate.

Aphria’s largest segment is expected to be hit the hardest this quarter. Bottomley expects a 17% drop quarter over quarter due to COVID headwinds, which include a reduction in the number of elective medical procedures and fewer visits to physicians/pharmacies by patients. They are forecasting C$92.1 million in revenue for this segment.

Bottomley expects that gross margins will remain strong during this quarter, at 28.2% or C$44.1 million. He expects adjusted EBITDA to come in at C$13.3 million as the company realizes higher operating leverage. He adds, “we believe Aphria will remain one of the only profitable LPs among market share leaders in Canada at this time.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.