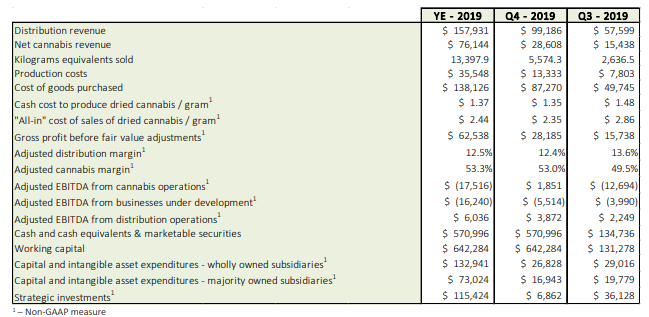

After the bell Aphria released earnings for Q4 and FY2019. The highlights include:

- Net revenue of $128.6 million in the fourth quarter, an increase of 75% from prior quarter and 969% from prior year.

- $99.2 million worth of distribution sales from CC Pharma, a German medical marijuana distributor, and other distribution outfits.

- Revenue for adult-use cannabis of $18.5 million in the fourth quarter, up 158% from prior quarter.

- Settlement of Green Growth Brands takeover bid resulting in $50 million cash received and an additional $39 million to be received in November.

- The company recorded an operating loss for the year of approximately $145M.

- The company had a $50M impairment in Goodwill on their LATAM acquisitions on the year.

From the MDAs:

Over the last six months, our organization identified immediate priorities to help generate substantial progress near-term and long-term. We built upon existing business fundamentals and capabilities, streamlined processes, strengthened governance, and focused on building brand awareness. Together, we have nurtured an entrepreneurial culture of accountability through data-driven decision-making for value creation in the global medical and adult-use cannabis industry. Today’s Aphria has a stronger foundation for long-term growth and success.

Irwin Simon, CEO Aphria

The early reactions from Twitter:

$APHA wasn't "bad news that wasn't great" per this tweet yesterday; this was actually a good quarter in the face of terrible sentiment, sector towel-tossing and rumors of a massive write-down. If I had a flag, I would toss it; the street is off-sides. /position $APHA https://t.co/pSw4MgugK9

— Todd Harrison (@todd_harrison) August 1, 2019

Typo in the $APHA earnings headline. Cannabis revenue was up 85% with sales up a whopping 110%. Doubling their market share.

— Scott Willis (@ScottW_Grizzle) August 1, 2019

And of course, not all positive with long time FinTwit’s

Jonathan Goldsmith fanboy stating:

What's strong about it?

— Amin Zee (@AminZadeh14) August 1, 2019

Most revenue not from cannabis and margins are weak.

Most investors haven't read the press release beyond the revenue number.

This stock will come back down.

More to come later.

Information for this briefing was found via Sedar and Twitter. The author is short Aprhia via Puts and has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.