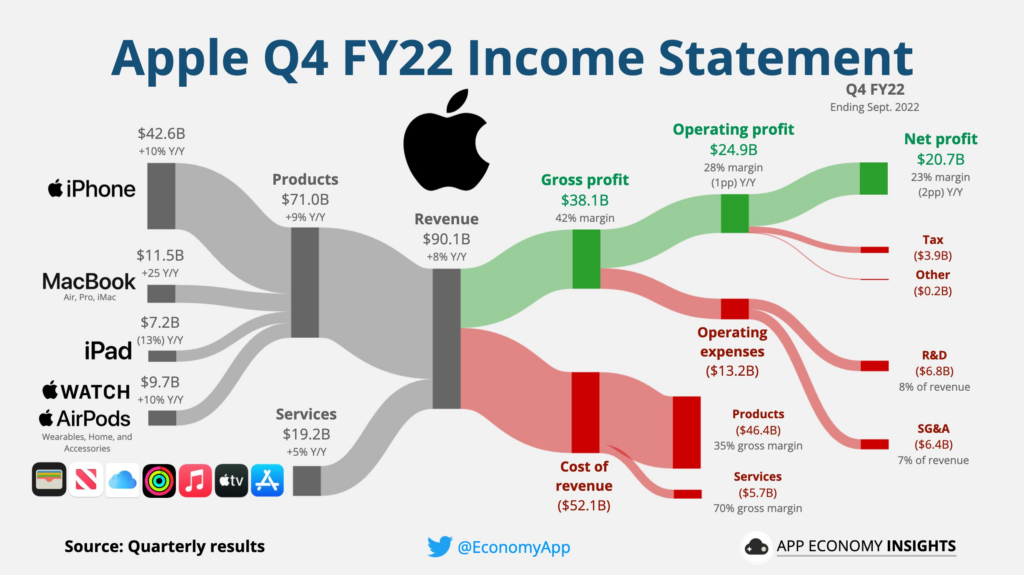

Apple (NASDAQ: AAPL) reported its fiscal Q4 2022 financials on Thursday post-closing bell. The tech giant generated US$90.15 billion in revenue, up from last quarter’s US$82.96 billion and last year’s US$83.36 billion.

The topline figure also beat the street estimate of US$88.90 billion.

“Our record September quarter results continue to demonstrate our ability to execute effectively in spite of a challenging and volatile macroeconomic backdrop,” said CFO Luca Maestri. “This quarter capped another record-breaking year for Apple, with revenue growing over $28 billion and operating cash flow up $18 billion versus last year.”

Gross margin for the quarter ended at 42.3%, marginally unchanged from last quarter’s 43.3% and last year’s 42.2%.

The smartphone maker also notched a quarterly net income of US$20.72 billion, an increase from US$19.44 billion in the previous quarter and US$20.55 billion from the year ago period. The bottomline figure translates to US$1.29 earnings per share, also beating the estimate of US$1.27 per share.

“This quarter’s results reflect Apple’s commitment to our customers, to the pursuit of innovation, and to leaving the world better than we found it,” said CEO Tim Cook. “As we head into the holiday season with our most powerful lineup ever, we are leading with our values in every action we take and every decision we make.

The tech giant has recently faced hurdles this month, including the firm’s vice president for procurement, Tony Blevins, leaving the company after making a crude joke on a now-viral TikTok video.

The European Parliament has also recently voted to require companies to adapt products — including iPhones — to use the USB-C as the standard for chargers.

Further down the financials, the company ended with a cash balance of US$23.65 billion, putting the current assets balance at US$135.41 billion. Current liabilities, meanwhile, came in at US$153.98 billion.

Late September, the phone maker reportedly told its suppliers not to proceed with efforts to increase production of the new iPhone models as the projected surge in demand failed to materialize.

Apple last traded at US$155.89 on the Nasdaq.

Information for this briefing was found via the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.