Apple opened 2.6% higher after its fiscal second-quarter results were released earlier in the week, with results blowing analysts’ expectations. The company announced second-quarter revenue of $89.6 billion, 54% year over year growth, and a gross margin of 42.5%. Net income came in at a second-quarter record of $23.63 billion, or a 26.4% net margin, and earnings per share of $1.40 were reported. All these numbers beat Refinitiv’s analyst consensus estimates.

A number of analysts increased their price targets off the back of these stellar earnings, bringing their average 12-month price target up from $152 to $154.82 from a total of 40 analysts who cover the name.

Below are the most recent analyst changes as of the time writing:

- BOFA Global Research raises price objective to $160 from $155

- UBS raises target price to $155 from $142

- Monness Crespi Hardt raises target price to $180 from $170

- Jefferies raises target price to $175 from $160

- Raymond James raises target price to $185 from $160

- Deutsche Bank raises target price to $165 from $160

- Wedbush raises target price to $185 from $175

- Citigroup raises price target to $170 from $150

- JP Morgan raises target price to $165 from $150

- Goldman Sachs raises target price to $130

- Goldman Sachs raises to neutral from sell

- Credit Suisse raises target price to $150 from $140

- Cowen and Company raises target price to $180 from $153

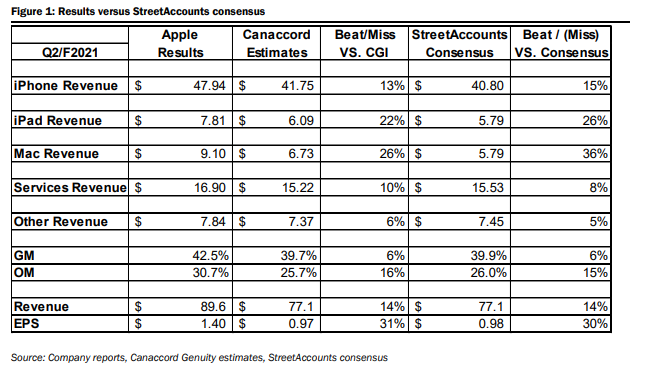

In Canaccord’s note following the results, their analyst Daniel Park raised their 12-month price target from $155 to $165 and reiterated their buy rating on the company. Park headlines, “Records are made to be broken; robust Q2 results across the board.” Apple beat all of Canaccord’s estimates. You can see that Apple’s total revenue came in 12% higher than Canaccord’s estimates. Park writes, “The company continues to demonstrate the strength of its product ecosystem with strong double-digit growth across all categories.”

The revenue beat primarily came from iPhone sales, which came in at ~$48 billion, a 66% year over year increase, which Park believes shows how sticky Apple’s customer base is while being positioned well for the remote work/learning headwinds that are still ongoing. Management reported that they expect sustained supply constraints during the June quarter to have a $3-$4B impact on top-line results but highlighted strong ongoing demand for the new iPhone lineup. Meanwhile the new Mac that has Apple’s own M1 chip was strong and the Services segment hit a new all-time high record of ~$17 billion for the quarter, up 27% year over year.

Canaccord is now increasing their top-line estimates off the earnings call last night due to strong second-quarter commentary. They are now modeling a 19% increase year over year for revenue with a strong 24% year over year growth in iPhone sales. Park writes, “We anticipate easy growth comps for iPhones given supply and pandemic issues last year combined with strong ongoing demand for the iPhone 12 lineup will drive strong YoY growth in Q3/F21. We anticipate ongoing strong annual growth trends in all other products.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.