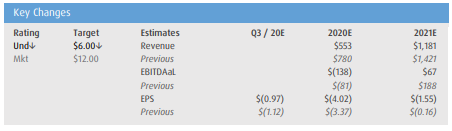

The Bank of Montreal this morning followed in Canaccord Genuity’s footsteps, downgrading Cineplex (TSX: CGX) to an underperform rating while the firms price target is at $6.00. The rating downgrade follows elevated concerns surround COVID-19 in Canada, along with film release postponements that have occurred as a result, with countless movies recently having been delayed including the latest James Bond 007 film. The bottom line, is “2020 is now a lost year for exhibitors like Cineplex.”

Public health concerns are among the key points outlined as being detrimental to the future of Cineplex. Analyst Tim Casey in his report this morning commented, “elevated COVID-19 cases in many parts of Canada have raised public health concerns, which will almost certainly affect attendance at Cineplex facilities in the near term.” The government of Ontario recently brought in mask rules and lowered crowd limits, which will negatively impact the theatre operator given that roughly half of its revenue comes from the province.

Competitors meanwhile such as Cineworld have indicated they are considering temporarily closing a sizable portion of their theatre chain due to the lack of new releases. With the second-largest global theatre operator electing to close numerous locations, it’s a bad sign of what’s likely to come for Cineplex.

Addressing the financial risks of such a situation, as well as declining revenues in general, Casey notes, “the dramatic reduction in revenues will affect credit risk. Cineplex recently renegotiated lending covenants (and issued $305 million in convertible debentures), which include a limit of 3.75x EBITDAaL through 2021 based on annualized quarterly metrics (instead of LTM) and step down to 3.0x at the end 4Q21.”

As a result, BMO Capital markets has lowered their box office and related revenue growth assumptions for Cineplex for the second half of 2020, as well as 2021 and 2022. The firm has estimated that revenue growth will fall -85% in the second half of 2020, and -30% in 2021 when compared to 2019. Previously, BMO had estimated that the third quarter would see revenue growth be -75% compared to 2019, while the fourth quarter was estimated at -25%, and 2021’s estimate was -15% versus 2019.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.