On June 8, Reuters reported that Apple (NASDAQ: AAPL) is in early-stage discussions with Chinese battery makers Contemporary Amperex Technology Co., Ltd., or more commonly called CATL (Shenzhen: 300750); and BYD Company Limited (OTC: BYDDF). CATL, which supplies batteries to Tesla, is the world’s largest automotive battery manufacturer, and BYD is an electric vehicle (EV) manufacturer and the world’s fourth largest battery maker.

Of course, these talks may not lead to an agreement. One potential sticking point: Apple reportedly wants a battery manufacturing facility to be built in the U.S.; however, CATL has expressed resistance to this idea for cost reasons as well as the fragile state of diplomatic relations between Beijing and Washington.

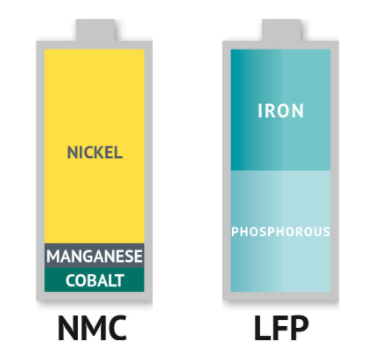

Perhaps the most salient part of the Reuters report is that Apple prefers lithium iron phosphate (LFP) cathodes in its battery design compared to that of nickel-cobalt-aluminum oxide or nickel-manganese-cobalt because of the higher costs of nickel and cobalt versus that of iron. LFP batteries have lower density than batteries containing nickel and cobalt, but that differential has narrowed. Indeed, last year Elon Musk said that the energy density of LFP batteries had improved significantly. CATL-made LFP batteries are now installed on Tesla Model 3 vehicles. BYD employs LFP technology on its Han EV model.

Separately, on June 10, Bloomberg reported that Apple has hired Ulrich Kranz — the former CEO of Canoo Inc. (NASDAQ: GOEV), itself an aspiring EV manufacturer, and before that a senior executive in BMW’s electric vehicle unit — to help lead Apple’s EV initiatives. At Apple, Mr. Kranz will join Doug Feld, a former Tesla top official, who now runs day-to-day automotive operations at the world’s most valuable company.

Apple’s talks with CATL and BYD and the Kranz hire, as well as previous leaks/discussions about an Apple EV, notably increases the chances the Apple initiative goes forward. In turn, given Apple’s sterling reputation and many consumers’ insatiable desire to own Apple products, an Apple electric vehicle seems likely to be highly sought after.

Furthermore, Apple’s embrace of LFP technology would have to be considered a positive for junior lithium miners like Lithium Americas Corp. (TSX: LAC) and Sigma Lithium Resources Corporation (TSXV: SGMA). On the other hand, Apple’s battery technology choice could, at the margin, have a negative read-through for nickel and cobalt miners.

Lithium Demand Projections

Rystad, an independent energy research and business intelligence firm, estimates that after satisfying existing requirements in the glass, ceramics and lubricating grease businesses and industries, operating lithium mines will produce, on a worldwide basis, around 520,000 tonnes of lithium carbonate equivalent (LCE) in 2021. This quantity is more than enough to satisfy the approximate 300,000 tonnes that EV battery manufacturers require this year.

Given planned mining capacity additions, the amount of LCE capacity available to EV battery manufacturers in 2025, after covering the demand of the other industries noted above, should reach 1.3 million tonnes. EV battery demand for LCE may reach around one million tonnes in that year, so supply is still projected to cover demand four years from now.

However, as EV demand is forecasted to continue to soar, the supply-demand balance could flip to a deficit position in 2026 and reach more than an 800,000-tonne net supply shortfall in 2028. At that time, total annual LCE demand could reach 2.8 million tonnes. This problem cannot be easily remedied: given government approval timeframes and regulatory schedules in many jurisdictions, an LCE project proposed today could take 5-7 years to develop, finance and build.

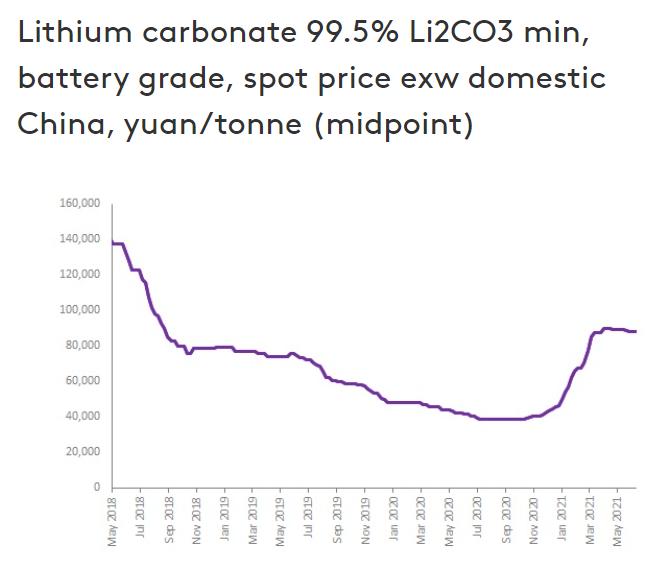

LCE prices have approximately doubled over the last six months, but the soaring demand outlined above could cause prices to increase even more significantly. Indeed, current prices are still about 30% lower than they three years ago.

Lithium junior miners could get a boost from Apple’s EV battery strategy. Even more, miners like Lithium Americas and Sigma Lithium with established projects in development, seem poised to benefit from seemingly limitless demand from EV battery manufacturers and inadequate future project mining capacity additions. LCE prices have increased noticeably over the last six months, and further gains are possible.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.