On April 23, shareholders of Northern Genesis Acquisition Corp. (NYSE: NGA), a special purpose acquisition company or SPAC, approved its merger with The Lion Electric Company, an innovative Quebec-based electric vehicle (EV) medium- and heavy-duty truck and bus manufacturer.

After NGA files an amended Form 10-K annual report with the United States SEC, which reclassifies certain warrants as derivative liabilities per that regulatory body’s new guidelines, the merger will close and The Lion Electric Company will trade under the new symbol LEV on both the NYSE and the TSX.

Lion has received three key orders for its trucks and buses over the last ten months. First and most prominently, Lion received an order from Amazon in June 2020 for the purchase of up to 2,500 aggregate Lion6 and Lion8 trucks over the period 2021 – 2025. To accommodate this, Lion must reserve sufficient manufacturing capacity to deliver 500 trucks per year and has agreed to dedicate 10% of its manufacturing capacity to Amazon over the 2026 – 2030 timeframe to continue to deliver 500 trucks annually.

To satisfy its Amazon contract, Lion placed a US$234 million order with Romeo Systems, Inc. for battery modules and packs for Lion’s Class 6 and Lion’s Class 8 vehicles over a five-year period starting on 2021.

Another aspect of the Lion-Amazon agreement: Amazon received warrants to purchase up to a 19.99% ownership stake in Lion, of which 3 percentage points has already vested. To receive the full quantity of warrants, Amazon must spend US$1.1 billion on Lion products. The warrants vest over an eight-year period.

Second, in September 2020, Canadian National Railway ordered 50 zero-emission trucks from Lion. Finally, Transdev Canada placed a C$4.5 million order for 27 new electric school buses in June 2020. Lion believes that the total annual addressable market for its products in the U.S. and Canada is around US$110 billion (US$100 for EV trucks and US$10 billion for EV buses).

Lion Electric’s Lofty Financial Projections — Perhaps More Realistic than Other SPAC EVs

Upon merger completion, Lion should have net cash of about US$443 million, based on US$494 million of cash less debt of US$51 million. Consolidated shares outstanding are expected to be about 195 million, and factoring in NGA’s current share price of US$18.46, Lion’s stock market capitalization and enterprise value are approximately US$3.6 billion and US$3.16 billion, respectively.

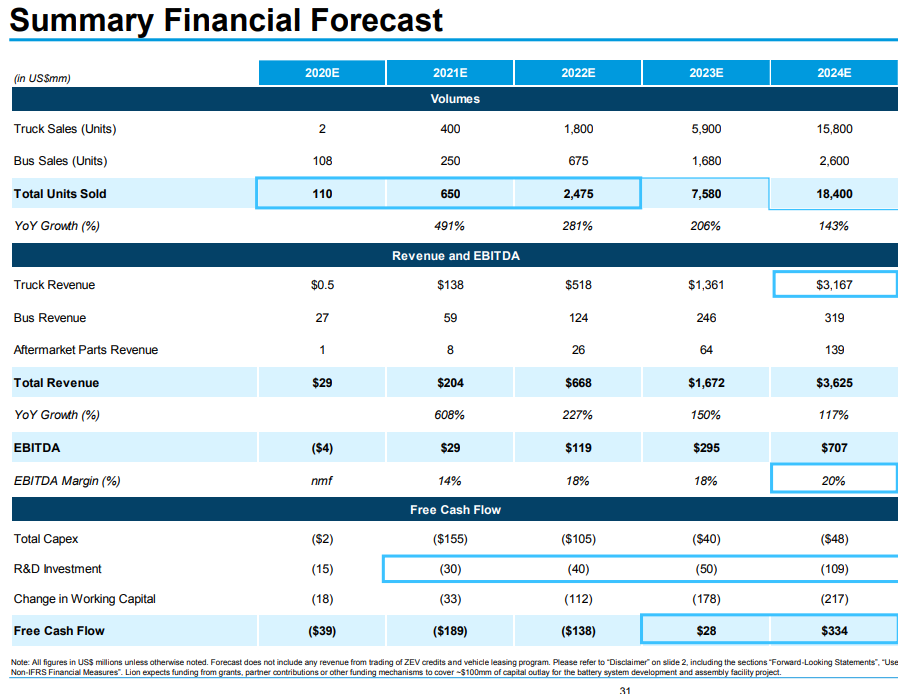

Lion projects that it will sell 2,475 electric vehicles (trucks and buses combined) in 2022 and 18,400 units in 2024. If it does so, it could generate about US$700 million and US$300 million of EBITDA and free cash flow, respectively, in 2024. If those projections are realized, Lion is currently trading at an enterprise value-to-2024E EBITDA ratio of just 4.5x.

To put that valuation into perspective in the SPAC EV space, Lucid Motors expects to realize approximately US$600 million and negative US$1.5 billion of EBITDA and free cash flow, respectively, in 2024. Based on this EBITDA projection, Lucid trades at enterprise value-to-2024E EBITDA ratio of around 50x. (We do note that Lucid produces luxury EVs while Lion manufactures EV trucks and buses.)

Like most SPAC EV companies, Lion’s projections call for sharp, almost exponential, increases in revenues and cash flows a few years out. While it is unclear if that will occur, Lion does have the distinct advantage of a large sales contract from Amazon. Furthermore, Lion’s valuation based on 2024 projections seems attractive versus other EV players, including Lucid.

Northern Genesis Acquisition Corp. last traded at US$18.46 on the NYSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

3 Responses

thank you for sharing, what’s next?

Electric Last Mile Solutions also attractively valued…or rather undervalued.

I think this latest article is missing at least a couple of orders from big organizations, Los Angeles Unified School District and Pride Group Enterprises. Also missing the IKEA – Second Closet partnership deal