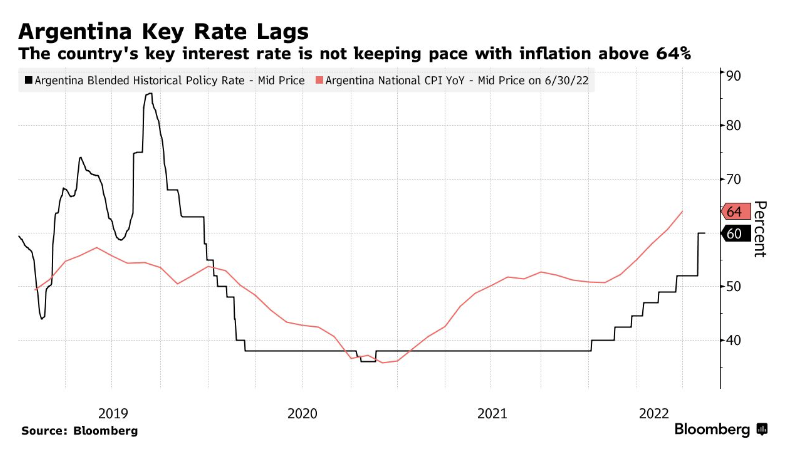

Argentina’s central bank urgently raised borrowing costs by a staggering 950 basis points this week, in face of 20 year-high inflation that continues to spiral out of control.

The Central Bank of Argentina hiked its benchmark interest rate for the 28-day term from 60% to 69.5% on Thursday, merely two weeks after delivering an 800 basis point increase amid a government cabinet overhaul that appointed a new economy “superminister.” The colossal rate hike comes after latest inflation data showed consumer prices jumped 7.4% in July, bringing the country’s annual inflation rate to a 20-year high of 71%.

Argentina’s central bank said the unprecedented increase in borrowing costs “will help reduce inflation expectations for the remainder of the year and consolidate financial and exchange stability,” while also bringing interest rates closer “to a positive terrain in real terms.” Argentina’s economy has been plagued with catastrophic debt levels as well as a government addicted to overspending; according to sources cited by CNBC, the country’s inflation rate is expected to hit 90% by the end of 2022.

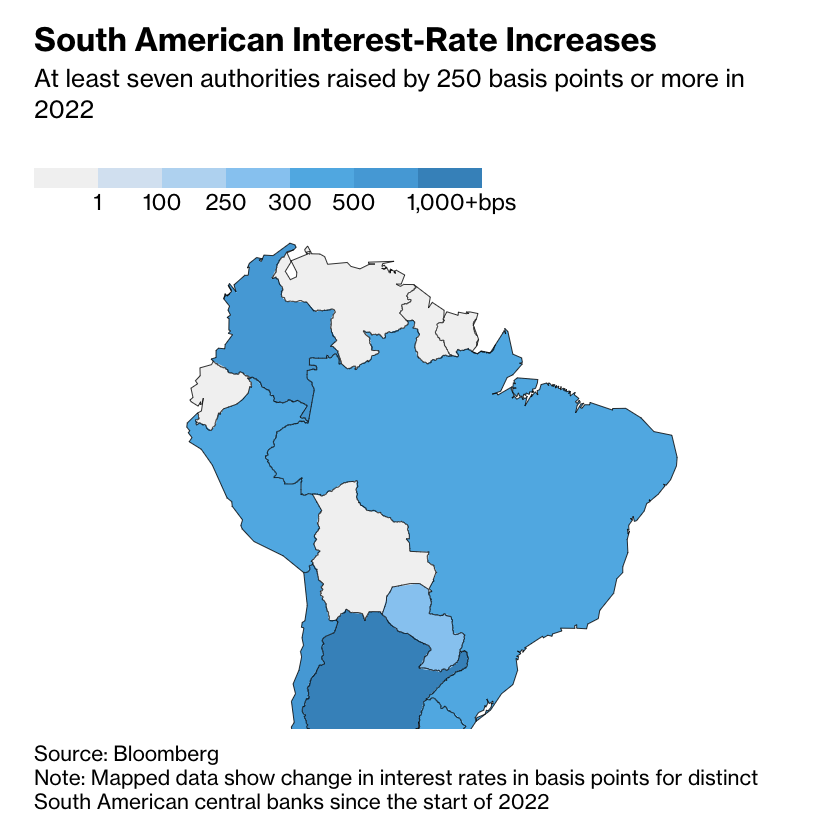

The latest figures come at a dismal time for other countries in the region as well: Mexico’s annual inflation rate jumped to 8.15% in July— the highest since December 2000, prompting the country’s central bank to raise rates by 75 basis points to 8.5%.

Information for this briefing was found via CNBC and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.