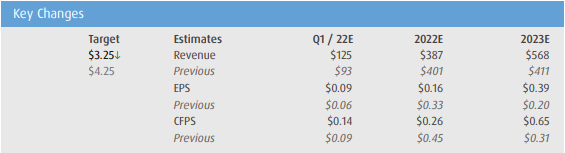

On March 3rd, Argonaut Gold (TSX: AR) announced that it has closed a bought deal. The company said it sold 3.91 million Canadian Exploration Expense and 15.87 million Canadian Development Expense shares for gross proceeds of $51.84 million from the flow through financing. As BMO Capital Markets was the lead underwriter, they restricted their coverage on Argonaut Gold, but on March 7, they resumed their coverage with an outperform rating while lowering their 12-month price target from C$4.25 to C$3.25.

Argonaut Gold currently has 10 analysts covering the stock with an average 12-month price target of C$3.43, which represents a 40% upside to the current stock price. Out of the 10 analysts, 1 has a strong buy rating, 8 analysts have buy ratings and 1 analyst has a hold rating. The street high sits at C$4.25, which represents a 73% upside to the current stock price.

In BMO’s note, they say that during their restricted period, the company had a number of news releases. Firstly, the company issued better-than-expected fourth-quarter production results but their 2022 production guidance was lower than their estimates. 2022 guidance is the largest factor in BMO’s rationale to lower their price target, saying that the guidance of 200,000 to 300,000 of gold equivalent ounces at $1,415 to $1,525 per ounce all-in, represents a 12% decrease in production and 13% increase in costs.

Next, BMO says that the recent equity raise of $58.1 million will help fill the company funding gap, as the company ended 2021 with $199 million in cash, $100 million available in a revolving credit facility, while slated to fund $357 million in CAPEX remaining at their Magino facility. They believe that the companies recently announced gold price protection suggests that Argonaut will look to tack on additional debt but BMO is modeling that the rest of the financing will come in as equity.

Lastly, BMO says that the fourth quarter production results came in slightly ahead of their expectations. Argonaut Gold recorded production of 61,900 gold equivalent ounces versus BMO’s estimate of 59,500 ounces.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.