A battle appears to be brewing between junior exploration firm ATAC Resources (TSXV: ATC) and Victoria Gold (TSX: VGCX) related to a buyout offer made by Victoria in early January. It appears that the junior explorer hasn’t exactly been willing to play ball on the offer.

Victoria Gold yesterday revealed that it had made an offer on January 12 via a non-binding proposal to acquire ATAC for $0.12 per share, which would be payable in Victoria Gold shares. Five days later however, its offer was declined, which after further discussions was “formally declined” on February 7.

The offer, as per Victoria Gold, represents an 85% premium to the closing price of ATC on Friday, however it represented a 36% premium at the time of offer.

“Our offer is more than reasonable given that, although we see opportunities at ATAC’s properties, we are also aware that risks lie ahead, including the uncertainty surrounding the advancement of permits at the Rackla Gold Property. We will not be increasing our offer consideration. We are disappointed our offer has not been taken to ATAC shareholders and we hope that ATAC’s Board of Directors will reconsider not allowing shareholders to decide the outcome for their company,” said Victoria Gold CEO John McConnell yesterday in relation to its offer.

The ATAC Resources rebuttal

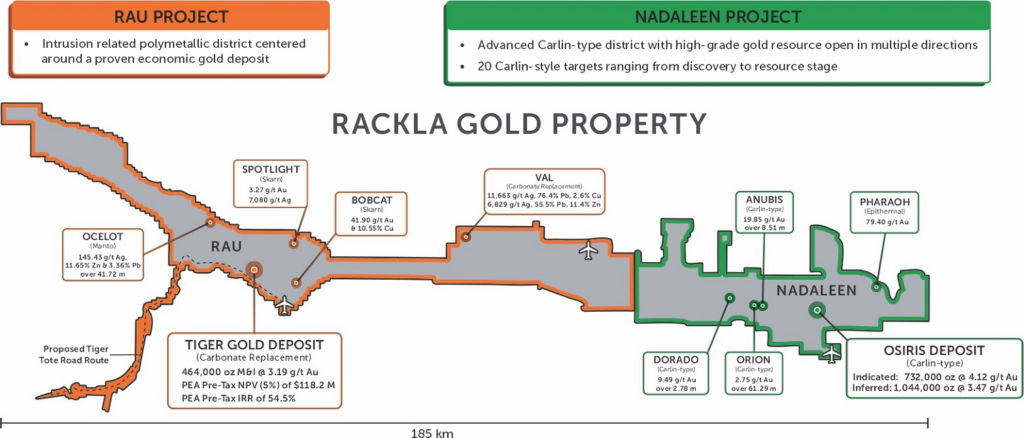

With the offer and related discussions made public yesterday, ATAC was forced to respond, wherein it indicated that it “did not believe the Offer fully captured the significant value of ATAC, including the district-scale precious and critical metals potential of its Rackla Gold Property and ATAC’s other properties in the Yukon and British Columbia.” The firm also reportedly had issues with the offer containing “numerous deal conditions.”

In short, ATAC, despite its valuation ascribed by investors, was looking to obtain a higher price that better reflected the “significant investments made to-date at Rackla,” as well as the resource estimates contained at two gold deposits, and the exploration expenditures it has amassed in the process. The firm also felt the price did not properly represent the “future upside and the potential of its portfolio of discovery-stage copper-gold projects.”

The firms Rackla Gold project currently boasts two gold deposits, the Tiger Gold Deposit and the Osiris Deposit. The Tiger Gold deposit contains 464,000 ounces of gold on a measured and indicated basis at 3.19 g/t gold. The Osiris Deposit meanwhile has indicated resources of 732,000 ounces of gold at 4.12 g/t, and inferred resources of 1.04 million ounces of gold at 3.47 g/t. The property itself, found in the Yukon, covers 1,700 square kilometres and is wholly owned by ATAC.

“With over $4 million in cash in our treasury, a strong resource base at Rackla, and compelling discovery potential across our project portfolio, we believe this offer does not reflect the significant value of ATAC,” stated ATAC Resources CEO Graham Downs, adding that the firm has been actively exploring the region for 20 years.

The response however seems to ignore the fact that investors themselves appear to have lost faith in the firms ability to prove out its projects. The company hasn’t hit the offer price of $0.12 since July 2022, when a one day surge topped out at that price. Prior to that single day, the equity hasn’t seen $0.12 or higher since April 2022.

Another issue, as highlighted by investors on social media, is that CEO Graham Downs, despite his efforts for two decades on the project, holds just over 370k shares in the company, as well as 1.25 million options and 27k warrants – not exactly a vote of confidence from the head of the firm whom has been at the helm for so long.

Victoria Gold responds

The latest development in what is becoming a saga saw Victoria Gold this morning comment that its “numerous deal conditions,” are standard and customary for such a transaction, and the deal contained no financing requirements.

“We are prepared to promptly allocate the resources necessary to complete our confirmatory due diligence and have a team assembled for short-notice deployment upon your advisement. We anticipate that the balance of our confirmatory due diligence can be completed quickly, and that we can implement the Proposed Transaction in a relatively short time frame,” said the company.

The offer remains open for ATAC and its shareholders until February 17 at 5:00 PM. The deal notably contains a smaller premium than it did just 24 hours ago however, with ATAC rallying 38.5% yesterday on the news of the offer coming in last month, closing the day at $0.09 per share.

ATAC Resources meanwhile has said that it is in the process of evaluating alternatives with financial advisors, with discussions ongoing.

Victoria Gold last traded at $9.41 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.