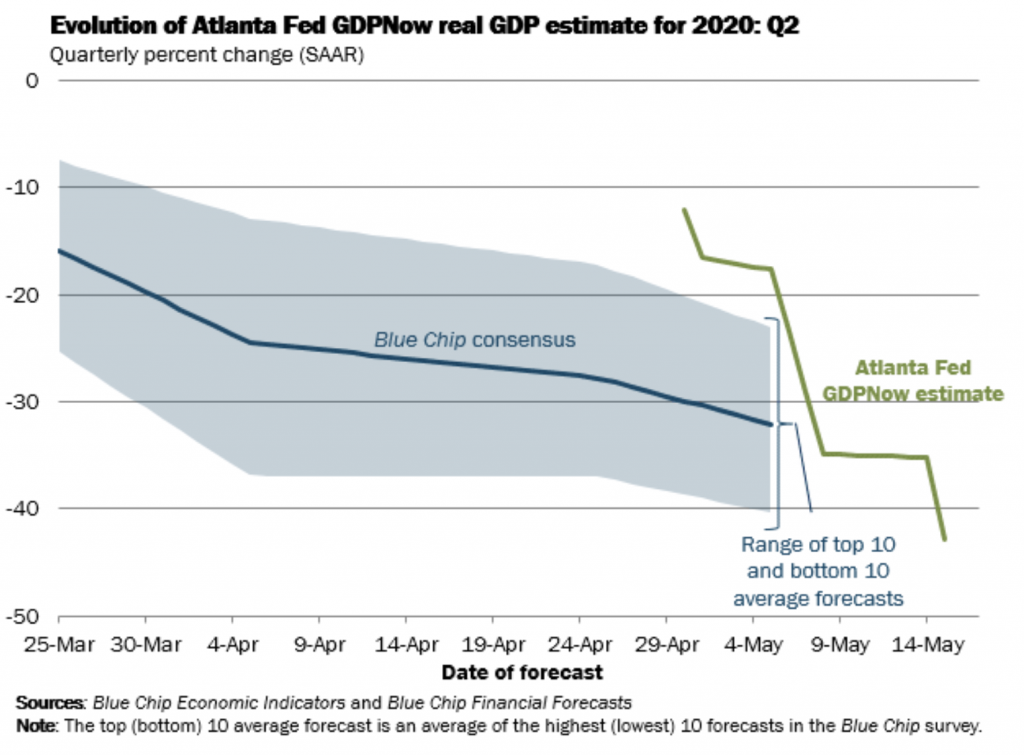

As previously reported on The Deep Dive, the Federal Reserve Bank of Atlanta, which runs an econometric model to produce GDP forecasts, recently released its second quarter 2020 GDP predictions of -34.9%. Now however, their model has produced an even more grim forecast.

On May 15, the Federal Reserve Bank of Atlanta’s GDPNow model forecasts an economic decline of 42.8%, which is a stark contrast to its previous predictions of -34.9%. The model uses an assortment of variables, most notably derived from data released by the US Bureau of Labour Statistics, US Department of the Treasury’s Bureau of the Fiscal Service, the US Census of Bureau, as well as the Federal Reserve Board of Governors.

Such a forecast suggests the US economy is in a much deeper hole than previously anticipated, with a U-shaped recovery rather than a V-shaped recovery becoming more evident.

Information for this briefing was found via the Federal Reserve Bank of Atlanta. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.