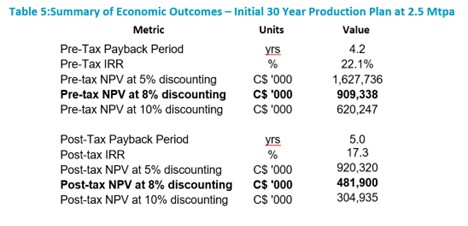

Atlas Salt (TSXV: SALT) last night released the results of a preliminary economic assessment for it s Great Atlantic Salt Project, found on the west coast of Newfoundland. The report was headlined by a pre-tax net present value with an eight percent discount of $909 million, and a project payback period of 4.2 years.

The PEA proposes a thirty year mine life for the project based on an underground mining model, with base case production of 2.5 million tonnes per year. Potential expansions of the mine contemplated include increasing production to 4 million tonnes per year, or extending the life of mine further. Mine access and infrastructure under the PEA was designed for the expanded capacity.

Total capital costs to develop the mine are estimated at $1.1 billion, while operating costs over the life of the mine are estimated at $2.7 billion, with life of mine unit costs sitting at $36.59 per mt shipped.

Post-tax internal rate of return is estimated as being 17.3%, with the post-tax net present value at 8% discounting estimated at $481.9 million. Estimates are said to be based on a Q4 2022 base price of $68.74 per mt, and a year 1 sales price of $86.94 per mt, which represents a 4% annual increase to the price of salt. Costing meanwhile is based on 2.0% annual inflation for capital and operating costs.

“Even assuming a conservative flat production rate at 2.5 million tonnes over only 30 years, the cash flow model provides a base case evaluation that is quite compelling. Significant additional value can be attributed to the project given that mine infrastructure is designed for up to 4 million tonnes production with ample resources to extend production beyond 30 years. Future additional infrastructure could push annual production even higher. Long life cash flow comes at a premium,” commented company president Rowland Howe.

Mineral resources meanwhile were upgraded in conjunction with the completion of the PEA, with indicated resources amounting to 187.2 Mt of 96.4% salt, and inferred resources amounting to 999.4 Mt of 95.6% salt. 39% of the mine plan is said to be based on indicated resources, while the remainder is based on inferred resources.

In connection with the completion of the PEA, the company has reportedly “entered into discussions regarding Great Atlantic with interested parties including potential suitors,” suggesting the sale of the project might be on the table. The company meanwhile is said to be working towards completing a feasibility study on the project, which is slated to be completed in the first half of 2023.

Atlas Salt last traded at $2.14 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Actually Atlas has not found the edge of the deposit and it more then likely exceeds 2 billion tons. The 2.5 million ton/yr is very conservative and is simply a base case for consideration. The initial mine will be a super low cost 4 mil ton/yr and a simple and relatively cheap upgrade of an additional conveyor will at least double the output capacity. The mine will use ramps and be the lowest cost producer in north america. They will be using an enclosed conveyor from the mine to the dock, no trucking needed. The thing will be a cash cow and those who buy now more then likely will not own the stock in the very near future as talks are happening now to buy out the company. In a few years they could easily ramp the production up to 8 or 10 million ton/year. The cost of the salt FOB the shipping vessel will be well under $23/ton and the whole sale price for road salt is hitting $114. Do the math, its a friken cash cow. Whoever owns the mine will control the road salt market for NA. oh and there is a current domestic production shortfall of about 12 million ton/yr.