Aura Minerals (TSX: ORA) is the latest company to report a decline in production within the first quarter, joining names such as Fortuna Mining and Endeavour Silver.

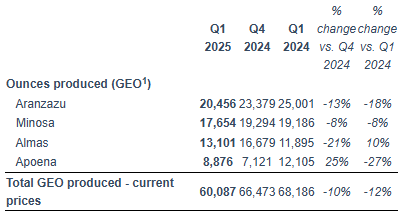

Aura in the first quarter reported total production of 60,087 gold equivalent ounces. The figure amounts to a decline of 12% on a year over year basis from the 68,186 GEO’s produced in Q1 2024, and a decline of 10% from the 66,473 GEO’s produced in the fourth quarter.

Part of that decline however is attributed to the rising price of gold, with production declining 7% year over year and 9% quarter over quarter when on a constant price basis.

Declines in production on a year over year basis were across the board, with only the Apoena mine reporting any semblance of improvement, with the mine seeing a 25% production increase versus the fourth quarter figures. All four operating mines are said to have performed in-line with expectations however, with the decline in production said to be as a result of mine sequencing.

The quarter also saw mining operations begin at a fifth mine, Borborema, however no ounces were contributed to production due to the mine coming online in late March. The new mine is expected to produce between 33,000 and 40,000 ounces this year, with the mine slated to be one of the largest and lowest cost operations within Aura’s portfolio.

“We started 2025 positively with the investment in Borborema construction was concluded on time and on budget. Now, the ramp-up should finish by Q3 2025, and then Borborema will become a key asset for Aura, with one of the company’s largest resource bases and lowest cash costs in our portfolio,” commented CEO Rodrigo Barbosa.

Aura has indicated meanwhile that it remains on track to achieve its prior guidance of 266,000 to 300,000 gold equivalent ounces of production in 2025.

Aura Minerals last traded at $25.00 on the TSX.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.