On Thursday, February 11th, Aurora Cannabis (TSX: ACB) (NYSE: ACB) is scheduled to release their second fiscal quarter 2021 financial results.

Aurora currently has 13 analysts covering the company with a weighted 12-month price target of C$11.95. This is up slightly from last month, which was C$11.41. Ten analysts have hold ratings, while one analyst has a sell rating and two have strong sell ratings on Aurora.

Matt Bottomley expects that Aurora’s results will be relatively flat. He writes that although Canada’s sale numbers have almost consistently hit all-time highs every month and Ontario is pushing out stores at 2x the normal rates, “we believe the economics captured by LPs will be slightly more muted due to saturated inventory balances held in provincial wholesale channels and the potential for continued infrastructure/inventory write-offs.”

He also believes that the product mix will still be value priced flower and not premium or 2.0 products, which will hurt Aurora’s overall growth for the quarter.

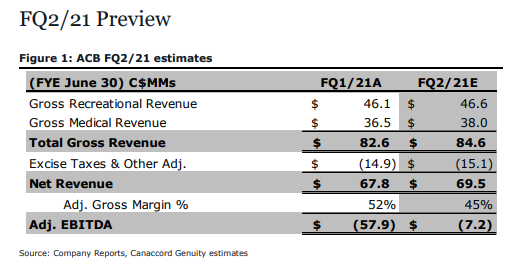

Bottomley forecasts Aurora’s net revenues will be C$69.5 million, or a modest 2.5% increase quarter over quarter. Of that, C$46.6 million is expected to come from Canadian adult use. He says that this is flat as, “the company continues to pivot toward a more ‘premium’ product strategy vs. its historical reliance on value priced bud.”

Bottomley also expects that Aurora’s increased product offerings will fall short in the near term as the company faces more headwinds.

Everything is not doom and gloom however, with Bottomley forecasting that Aurora remains the market leader in Canadian medical as they estimate the segment to generate C$38 million in revenues for the quarter.

Bottomley expects adjusted gross margin to be 52%, but says that after Aurora Sun’s closures and the drop in utilization at Aurora Sky that adjusted gross margin will be more like 45%. Bottomley writes, “we would not be surprised to see sizable impairment charges on the back of these closures.” Bottomley forecasts Aurora’s second-quarter EBITDA loss to come in at C$7.2 million.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.