On September 27, Aurora Cannabis (TSX: ACB) reported its fiscal fourth quarter results. The companies results pointed to both a sequential and year-over-year decline in revenue. Fourth quarter revenue was $54.61 million, a 1% sequential decline and a 20% decline year over year.

The company reported medical cannabis revenue up 9% year over year, with average selling prices rising 42% over the year. Selling, General, and Admin costs were also down 19% over the last year but the company still reported a negative $134 million net loss and negative $19.256 million adjusted EBITDA number for the quarter.

Two analysts have since lowered their 12-month price targets, bringing the average price target between 12 analysts to C$7.76, down from the C$8.40 before the earnings were released. Out of the 12 analysts, 7 have hold ratings, 3 have sell ratings and 2 have strong sell ratings. The street high sits at C$10 while the lowest comes in at a C$6 price target.

Canaccord lowered their 12-month price target yesterday morning, down to C$6.50 from C$7 while reiterating their sell rating on the stock. Canaccord saying that this quarter generally came in line with analysts’ expectations. It was just another “period of sequential lower revenues” Canaccord says.

For the quarterly review, Canaccord forecasted that net revenue would be $53.4 million, with adjusted gross margins of $20 million. The company beat revenue estimates but fell short on gross margins. Canaccord says that Aurora, “still boasts the largest domestic/international top line for medical sales,” while their Canadian recreational segment also saw an 8% uptick quarter over quarter, but it’s still 50% lower than what it was a year ago. Canaccord says, “we believe ACB’s FQ4 print will do little to re-engage investor excitement as the Canadian landscape remains troubled for many Licensed Producers.”

Finally, Canaccord calls Aurora’s C$421 million cash balance healthy but goes on to explain that in the process of raising C$666 million, it diluted investors 63%. They believe that Aurora’s at-the-market program, which is still active, will be limited to strategic opportunities.

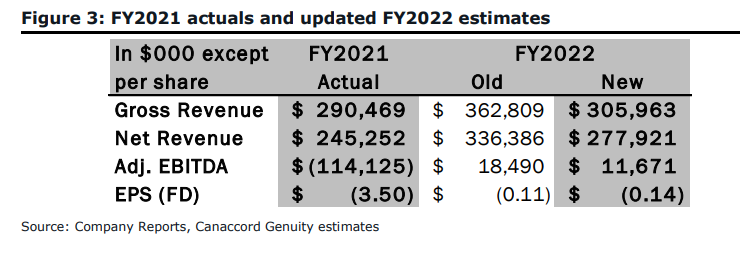

Below you can see Canaccord’s updated fiscal 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.