On November 9th, Aurora Cannabis (TSX: ACB) reported its fiscal first quarter financial results. The company reported total revenues of C$60.1 million, down 11% year over year but up 10% quarter over quarter. Of the $60.1 million revenue, $40.98 million came from the company’s medical segment which grew 17% quarter over quarter. The company reported gross profits of $25.45 million while SG&A costs totaled ~$45.8 million for the quarter.

The company posted a net loss of $11.88 million while adjusted EBITDA was negative $12.1 million. The company reported C$372.79 million of cash and equivalents with another C$51.51 million in restricted cash, while total liabilities came in at $535.34 million

A number of analysts changed their 12-month price targets on Aurora Cannabis after the results, bringing the average to C$7.73, or a 17% downside to the stock. The company currently has 13 analysts covering the stock with 8 having hold ratings, 3 have sell ratings and 2 have a strong sell rating. The street high sits at C$10.75 from Cantor Fitzgerald while the lowest comes in at C$4.

In Canaccord Genuity’s third-quarter review note, they reiterate their sell rating and cut their 12-month price target to C$6 from C$6.50 on Aurora Cannabis, saying, “International shipments aid in sequential growth while Cdn ops see incremental declines.”

For the results, Aurora came in slightly below Canaccord’s C$62.24 million revenue estimate. This miss was primarily due to its domestic sales declining by 2% and medical sales declining by 5%. While Canaccord warns that the net sales saw a huge bump due to bulk orders into Isreal, which “are typically lumpy in nature and subject to large fluctuations each period.”

Additionally, Canaccord notes that Aurora reported recreational sales in Canada of C$19.1 million which was down sequentially and 44% lower than last year. They believe that this is primarily a function of the company moving away from the value-oriented segments and into premium products.

Lastly, Canaccord says that Aurora boasts a healthy balance sheet with them raising C$666 million last fiscal year, increasing their share count by 63%. Canaccord also took away 2 main points from the earnings call. The first is Aurora’s step away from the value segment to a more premium segment. And the second is that Aurora continues its dominance in the medical market, having 23% of that market.

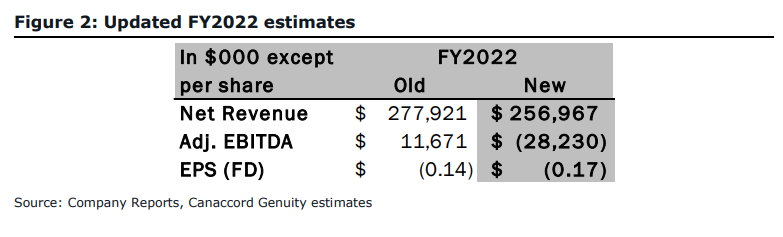

Below you can see Canaccord’s updated fiscal full-year 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.