Aurora Cannabis (TSX: ACB) (NYSE: ACB) appears to be in need of money again. The firm this evening filed a mammoth base shelf prospectus, enabling the company to raise up to US$500.0 million in aggregate over the course of the next 25 months.

Within, the prospectus was not overly specific to the type of security that may be sold, with the company listing the potential sale of common shares, warrants, options, subscription receipts, debt securities, and units. What was provided however was interesting details on ongoing events at the company.

For instance, on October 2, 2020 a class action lawsuit was commenced in the United States District Court for the District of New Jersey. The lawsuit is purportedly against the company, Michael Singer, and Glen Ibbott on behalf of investors that purchased shares in the company between February 13, 2020 and September 4, 2020, with the complaint alleging that the company failed to disclose it it significantly overpaid for previous acquisitions among other items.

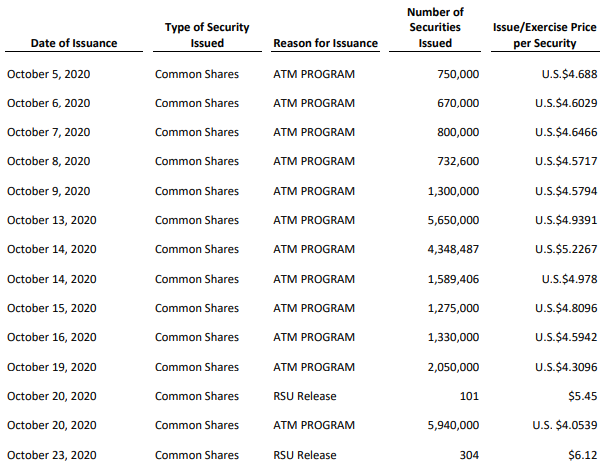

Even more interesting however, is the fact that the ongoing ATM program has raised gross proceeds of US$214.7 million since the date of the last financial statements, which were filed for the period ended June 30, 2020. At the time of release, Aurora had indicated that just US$36.6 million had been raised via the at-the-market financing subsequent to the filing period, with approximately US$183 million remaining available in the financing.

The impact of this result is that US$178.1 million has been raised directly via the public markets since September 22, 2020 – which averages out to approximately US$7.42 million per trading day. Effectively, this means that by end of day tomorrow (October 27, 2020), this financing will likely be entirely consumed. Overall, the company now has 160,656,048 common shares issued and outstanding – as compared to 115,228,811 on June 30, 2020.

In terms of use of proceeds, nothing specific was provided within the document given that it is a base shelf prospectus. Further details will be provided in any associated prospectus supplement filed when the company looks to actively conduct a financing.

Aurora Cannabis last traded at $4.40 on the NYSE.

Information for this briefing was found via Sedar and Aurora Cannabis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.