Aurora Cannabis (TSX: ACB) (NYSE: ACB) announced preliminary earnings results this morning for the period ended June 30, 2019. The company indicated that on an unaudited preliminary basis, revenues are expected to be up 53.6% quarter over quarter on low end estimates to $100 million for the three month period.

Providing total guidance of $100 to $107 million in revenues for the quarter, with cannabis revenues accounting for $90 to $95 million. Aurora identified that figures should be up across all lines of business, which shows signs that it is likely stealing market share from that of current sector leader Canopy Growth Corp. With competitor Aphria recently reporting cannabis sales being up 85.71% over a similar time period, Canopy is likely facing trouble in its most recent quarter based on overall market trends for the cannabis sector.

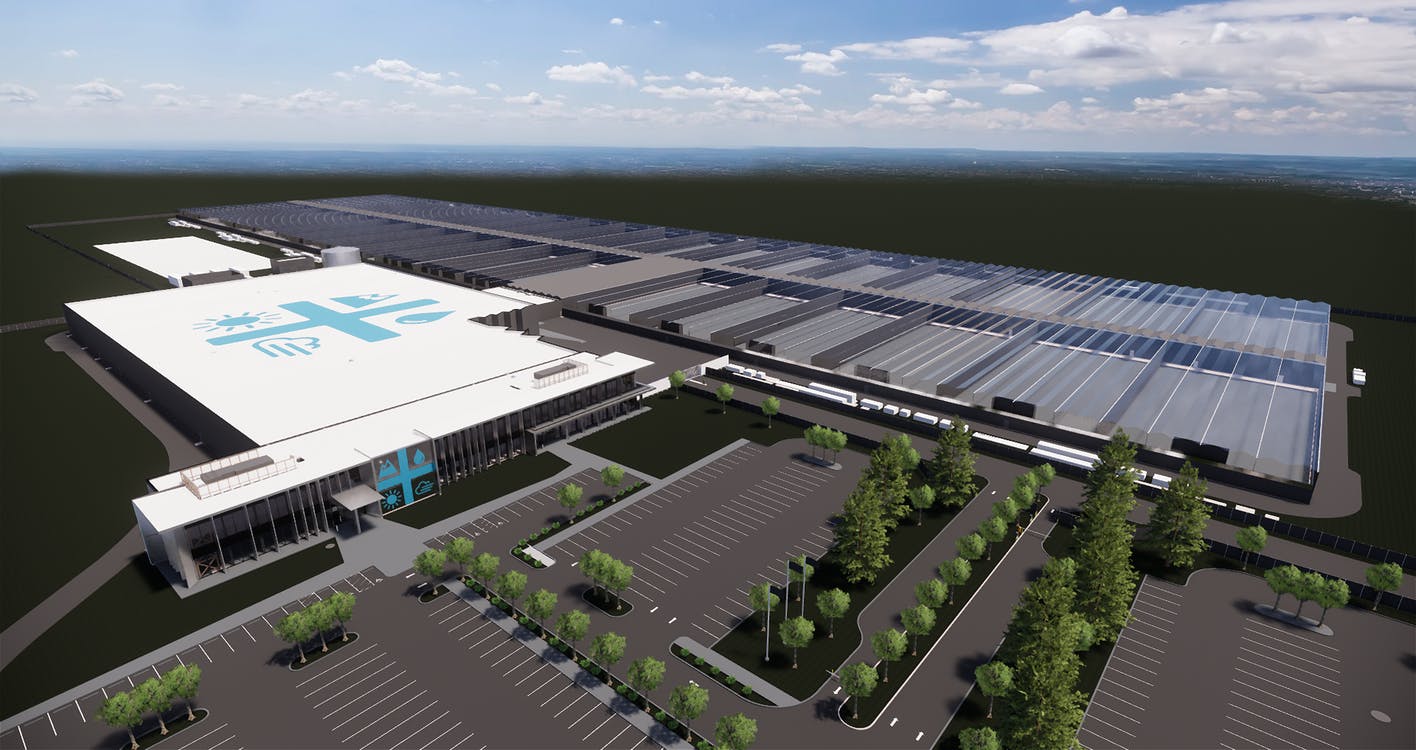

For the fiscal year ended June 30, 2019, Aurora Cannabis expects total net revenues to come in between $249 and $256 million, which is a significant increase over the previous year which saw a total revenue figure of $55.2 million. The increase comes on the back of the opening of recreational markets in Canada, as well as increased capacity across multiple of the firms facilities in the last year.

“We set out to be best-in-class cultivators, and through carefully evaluated acquisitions, that vision continues to drive exceptional results today. We are the leader in cultivation capacity, production available for sale and revenues for cannabis in the Canadian medical and consumer markets. We continue to lead the build out of European and other international medical cannabis markets. Our success to date comes from a focus on quality, regulatory compliance, appropriate Board of Directors oversight, and delivering a profitable, low risk and sustainable business for our shareholders.”

Terry Booth, CEO of Aurora Cannabis

Total production capacity for the fourth quarter is expected to come in between 25,000 KG and 30,000 KG. The figure is above the previously guided 25,000 KG figure.

Aurora Cannabis expects to file its audited annual financial statements prior to September 15, 2019.

Information for this analysis was found via Sedar and Aurora Cannabis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.