Auxico Resources Canada Inc. (CSE: AUAG) announced today the signed joint venture agreement with Cooperativa Estanifera de Mineradores da Amazônia Legal for the Massangana tailings joint venture in the State of Rondônia, Brazil. The project is estimated to contain 30.0 million tonnes of minerals, including 1.37 million tonnes of rare earth concentrate.

The mining firm is set to earn 85% of the joint venture’s profits by first paying US$2.0 million over the next year, followed by providing the capital to produce the expected concentrates. The company estimates a total of US$300.0 million for capital expenditures.

The project, designed in three phases, aims to demonstrate the feasibility of a 3.0-million-tonne annual throughput to produce three types of product: 135,000 tonnes of monazite concentrate, 19,500 tonnes of cassiterite concentrate, and 45,000 tonnes of columbite concentrate (50% niobium + 5% tantalum). The first phase involves jumpstarting the feasibility study.

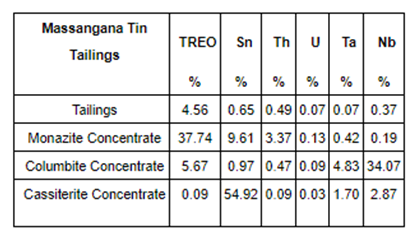

A study by German Mineral Resources Agency and the Geological Survey of Brazil estimates the concentrates of tin, niobium, and rare earths that can be produced from the said three products.

Phase 2 would involve operating at 100,000-tonne annual capacity throughput, “to produce rare earth concentrates that meet the international norms for the transportation of these materials.”

The last phase would entail shipping the concentrates from Brazil for a scoping study for the refining of rare earths in Little Rock, Arkansas.

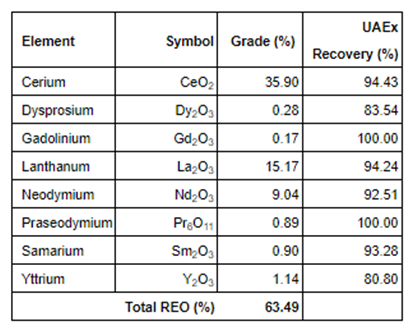

The tailings averaged 4.56% total rare earth oxide content, indicating 1.37 million tonnes of rare earth concentrate from the estimated 30.0 million tonnes of tailings. According to an analysis by Quebec-based Coalia Research Institute indicated through the results of its metallurgical testing, the provided concentrate contained 63.49% total rare earth oxide.

Auxico last traded at $0.80 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.