On January 20th, PI Financial became the fourth firm to cover Ayr Strategies’ (CSE: AYR.a). Their lead cannabis analyst, Jason Zandberg, initiated a price target of C$60 and a buy rating. He headlines, “Positioning for a Re-rating! Are You Ready for the Next Major MSO?”

Ayr Strategies currently has four analysts covering the company with a weighted 12-month price target of C$50.75. This is up from the average at the tail end of 2020, which was C$33.50. One analyst has a strong buy rating, while the other three have buy ratings on the company.

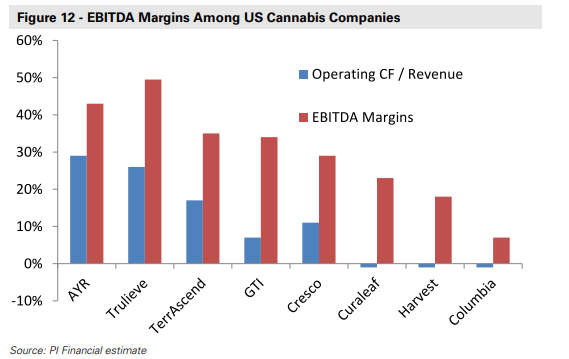

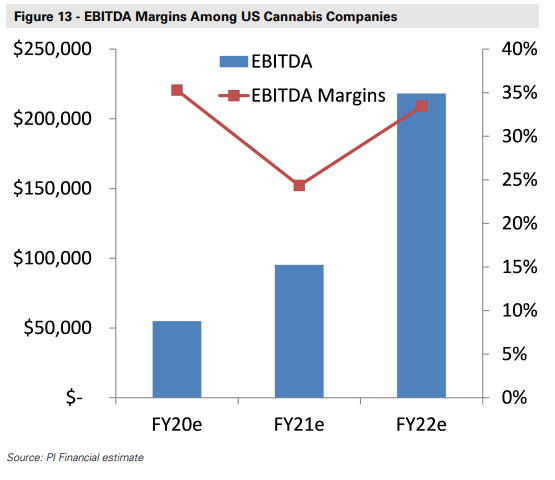

Zandberg says that Ayr, in its limited operating history, has been able to secure market dominance in Nevada and Massachusetts and has some of the highest EBITDA margins compared to peers. Ayr’s Q3 operating cash flow was 29%, making it the highest among its peers, while their EBITDA margins for the same quarter were 43% – making only Trulieve have better margins.

.

He writes, “With many acquisitions currently in the pipeline, the Company is set to significantly expand its market reach and enter the large-cap MSO peer group.”

Zandberg says that Ayr is the largest operator in Nevada, which will provide the company with a run rate of >U$110 million, with only 6 six dispensaries open. He adds, “The retail locations in Nevada boast some of the most impressive metrics in the industry with sales of US$4,700/sq. ft. and management believes its delivery platform is the largest in Nevada with a fleet of more than 50 delivery vehicles.”

In Massachusetts, Zandberg comments that AYR distributes its products into over 75% of the state’s dispensaries, and BDS analytics shows Ayr being the #1 wholesale brand in the states. He writes, “Its retail presence is also strong – Ayr has two medical dispensaries and has recently received its Host Community Agreement (HCA) approval for its three adult-use licenses in the Greater Boston area.”

He adds that Ayr’s exposure to New Jersey and Arizona is a positive, which are starting recreational cannabis in the next 12 months. Zandberg writes, “Typically when cannabis markets add adult-use sales to an already existing medical cannabis market, the market potential increases by a factor of 3x – 5x.”

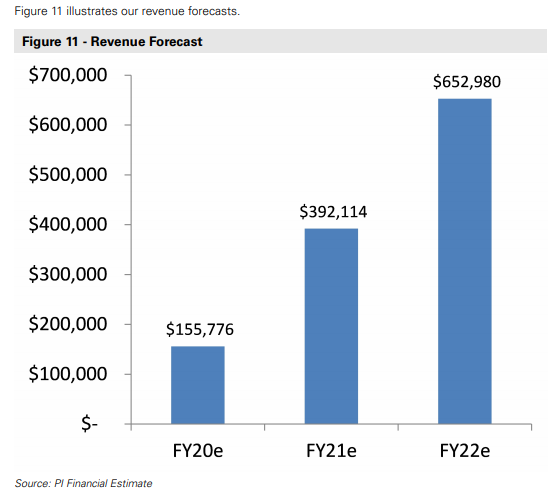

Zandberg expects that 2021 and 2022 have robust sales growth as Ayr closes multiple acquisitions; because of this, Zandberg believes Ayr has been under the radar and now believes that the company is “on the grid” in terms of state footprint. He writes, “The current fully diluted market cap is now CAD$1.87B, and we designate the cut-off between mid-cap and large-cap operators at $2.0B. We expect Ayr to cross that threshold in 2021.”

Below you can see PI Financial’s revenue and EBITDA forecast.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.