Ayr Wellness (CSE: AYR-A) is taking a major loss as it elects to exit its Arizona-based operations. The firm has sold off Blue Camo, LLC, which operated several assets under the Oasis banned in the state of Arizona.

The assets, consisting of three dispensaries in the Phoenix region, a cultivation and processing facility in Chandler, a cultivation facility in Phoenix, and an interest in a joint venture focused on developing an outdoor cultivation facility, are to be sold to AZ Goat, LLC. AZ Goat consists primarily of the former owners of Blue Camo, who are now ready to reacquire the assets at a steep discount.

Consideration for those assets is said to be $20 million in cash along with adjustments from net working capital that will be received within six months of closing. Lease obligations will also be assumed that remove $15 million in long term lease liabilities from Ayr’s balance sheet, while debt related to the acquisition of the assets in 2021 will be eliminated, further reducing the firms debt load by $22.5 million.

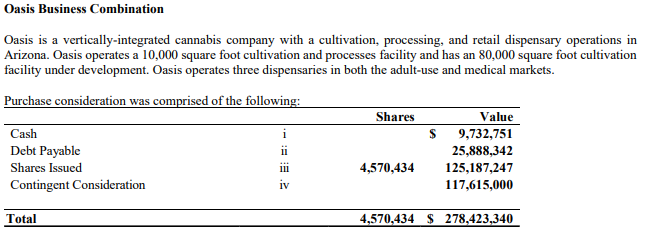

The sale represents a major loss for Ayr. While the company in last nights release announcing the sale indicated that $9.5 million in cash, 4.6 million in shares, and $22.5 million in sellers notes were used to pay for the assets, this heavily distorts the actual price paid by the company. At time of announcement, it was agreed that the firm would pay $9.5 million in cash, $37.4 million in shares, and a $28.5 million sellers note.

Filings from the time of the sale however paint a slightly different picture, indicating the company dished out $9.7 million in cash, $25.8 million in debt payable, $125.2 million in shares, and a further $117.6 million in contingent consideration.

It’s unclear if the contingent consideration was ever paid out. Even excluding that figure however, the sale of the assets for $20 million results in a loss of around $118.0 million once the written-off debt is taken into consideration. This of course doesn’t include the monies spent by the firm to finish the construction of the cultivation facility in Phoenix.

AYR Wellness purchased its Arizona asset in 1Q21 for a total consideration of $275m, inc $117m of contingent earnouts (which probably didn't get hit) so ~$160m.

— Justin (@YounggJustin) February 9, 2023

Today the company announces that it will sell that same asset for $20m in cash. $AYR pic.twitter.com/MkC603OpZh

Ohio asset purchase

Separately, Ayr attempted to soften the blow of the loss taken in Arizona by revealing it had entered option agreements to acquire two Ohio-based retail license holders, although neither license holder has an operational location currently. Details of the purchase terms were not provided either.

Ayr Wellness last traded at $1.69 on the CSE.

Information for this briefing was found via Sedar and Ayr Strategies. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.