Ayurcann Holdings (CSE: AYUR) is the latest cannabis firm to make its debut on the public markets. The firm formally began trading this morning, with the listing of its equity on the CSE following a reverse takeover transaction with that of Canada Coal.

The company bills itself as a market leader within the cannabis extraction space, where it focuses on providing “a turn-key post-harvest outsourcing solution for licensed cannabis producers.” The company as a result has three revenue segments, which include extraction and refinement, bulk oil sales, and white label manufacturing.

Holding both a processing and research license from Health Canada, the company focuses on processes that include extraction, refinement, formulation, packaging, fulfillment and distribution, for both the medical and recreational market.

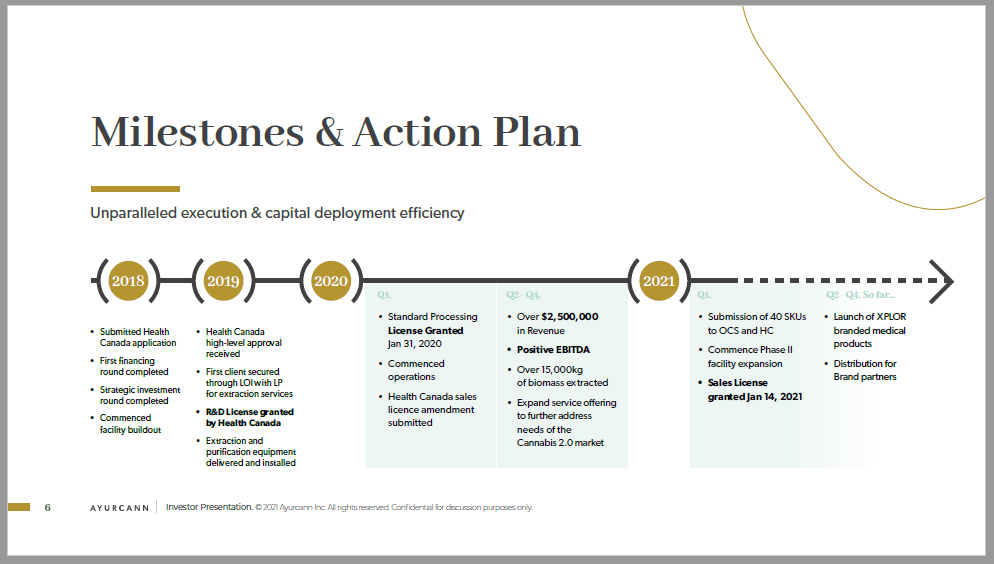

The company comes to the market as a semi-seasoned operator, having been awarded its standard processing license in January 2020, enabling the commencing of operations for the company. The company reportedly saw revenues in excess of $2.5 million from the second quarter through the fourth quarter of 2020, with over 15,000 kilograms of biomass extracted. To date, the company has seen over 20 different clients utilize its services.

The first quarter of 2021 meanwhile saw the firm begin their phase two facility expansion, while also receiving their sales license. Notably, 40 SKU’s were also submitted by the company to the OCS and Health Canada during this time, which will enable the company to soon begin the distribution for brand partners.

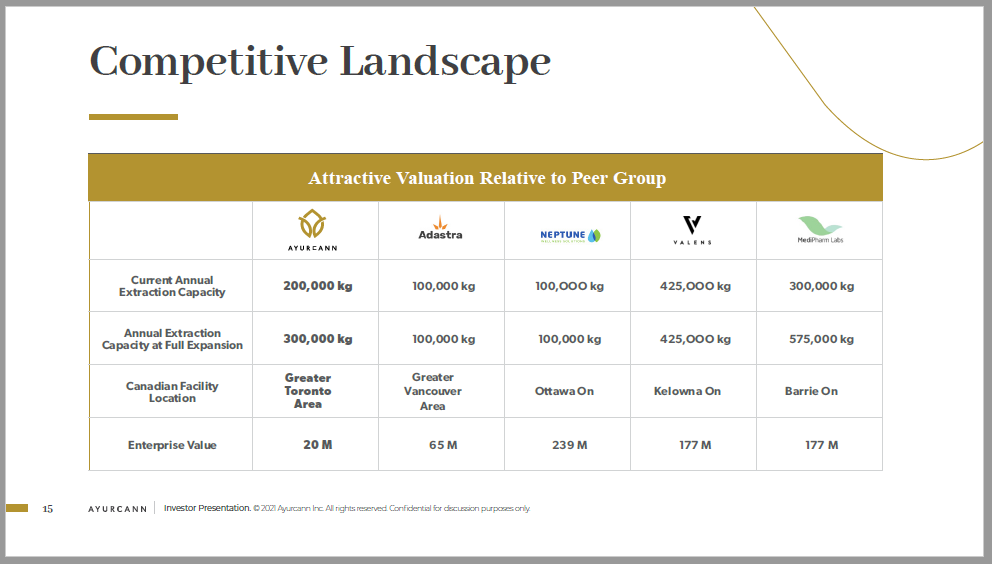

While its no secret that the extraction space has begun to get competitive, the company is well positioned among its peers. The company has a current annual capacity of 200,000 kilograms, making it third among its peers in terms of total capacity. The difference here however, is that it has one of the lowest enterprise values among its peers.

In terms of share structure, the company currently has a total of 101.0 million shares outstanding, along with 1.4 million options and 16.9 million warrants. Fully diluted, the share count as a result sits at 119.3 million.

Ayurcann Holdings last traded at $0.59 on the CSE.

FULL DISCLOSURE: Ayurcann Holdings is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Ayurcann Holdings on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.