The Bank of Canada is set to deliver yet another massive interest rate hike on Wednesday, even as economists increase their warning signal of a potential recession.

Markets and economists are split between expectations of a 75 basis-point hike or a full percentage point jump, but one thing is clear: another increase in borrowing costs will likely put Canada’s economy closer to a recession, against a landscape of decades-high persistent inflation. Last week, Finance Minister Chrystia Freeland sounded the alarm over a shift towards tougher times for Canadians. “Mortgage payments will rise. Business will no longer be booming,” she said. “Our unemployment rate will no longer be at its record low.”

The Bank of Canada has raised its overnight rate from 0.25% in March to the current 3.25%, marking one of the sharpest tightening cycles in monetary history; but, inflation still remains stubbornly high. Latest data from Statistics Canada showed prices were 6.9% higher from September 2021, while core CPI— the central bank’s preferred measure of inflation— remained unchanged from the prior month. “It’s pretty clear that more aggressive interest rate hikes are still warranted,” said RBC senior economist Nathan Janzen.

“There are some indicators that we’re past peak inflation rates. It’s just those inflation rates are still too high, currently, and still way too broad right now to prevent additional interest rate increases,” he added.

READ: OECD Anticipates Bank Of Canada Raising Rates As High As 4.5% By 2024

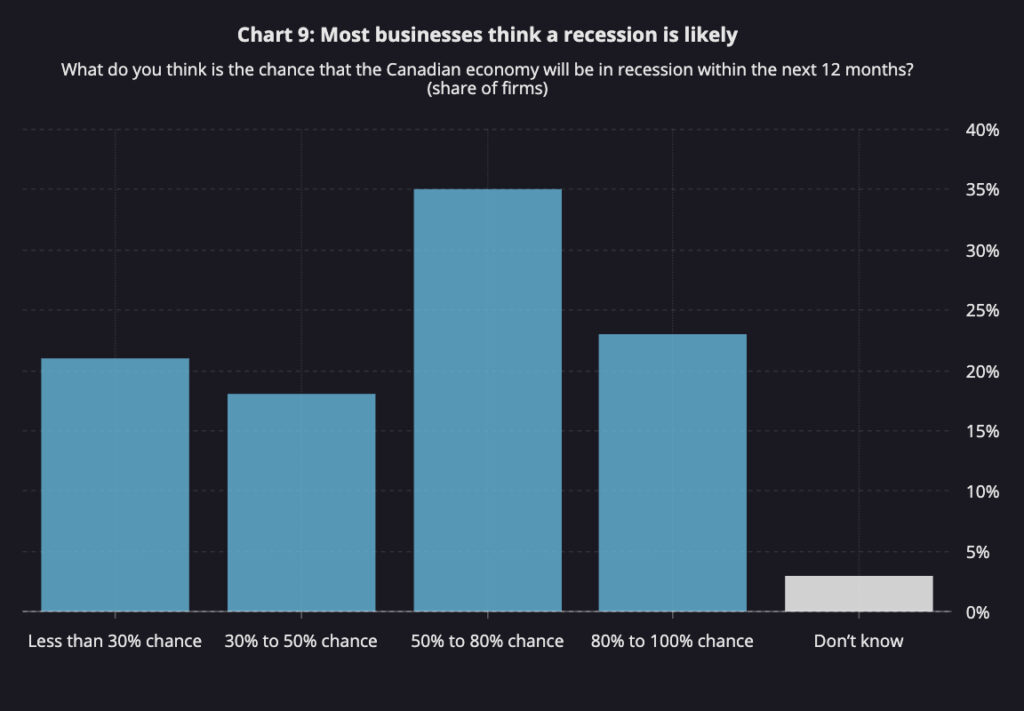

The brunt of the Bank of Canada’s rate hikes have yet to trickle down through the economy, but both businesses and consumers are already feeling the pressures of reduced purchasing power and higher borrowing costs. The central bank’s consumer outlook and business outlook surveys for the third quarter quarter suggest that an increased number of respondents are bracing for a looming recession.

Information for this briefing was found via RBC, the Bank of Canada, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.