Back in April, the Bank of Canada unveiled a $10 billion corporate bond buying program, which is to come into effect on May 26. Now that more details have been revealed, it appears that a significant portion of the program will be allocated towards companies in the energy and financial sectors.

The goal of the program is to increase liquidity in the market, as well as make it less burdensome for struggling companies to raise more funds. The BOC plans to earmark 28.3% of the program’s funds for the bonds related to financial institutions, 20.3% for energy company bonds, 14.3% for communications companies, and 15.4% for real estate companies.

Then to make it fair, the BOC will be utilizing a model portfolio in determining which companies in which provinces and territories will be targeted with the program. The model portfolio is based on a province’s or territory’s GDP contribution, as well as how many bonds the company has outstanding. Thus, Western provinces make the largest contributions to national GDP levels, but Eastern provinces such as Quebec and Ontario have the most outstanding bonds.

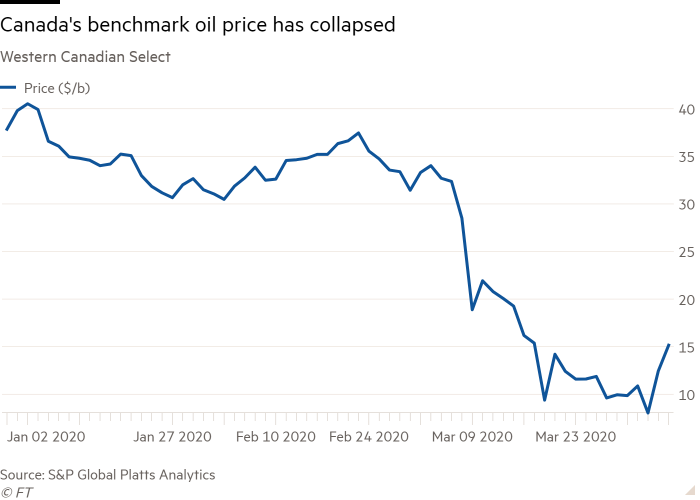

In order for a company to be eligible for the program, its bonds need be rated a minimum of BBB, and have a date to maturity within the next five years. However, those companies that had their bonds downgraded to -BBB anytime after April 15, are still suitable for the BOC program. As such, the energy sector has been hit hard with lack of demand for fossil fuels amid the pandemic, and as a result have suffered some form of recent credit downgrades.

Information for this briefing was found via the Globe and Mail. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.