Despite last month’s slowdown in headline inflation, many Bay Street economists still think the Bank of Canada will continue with its course of delivering another colossal rate hike come September.

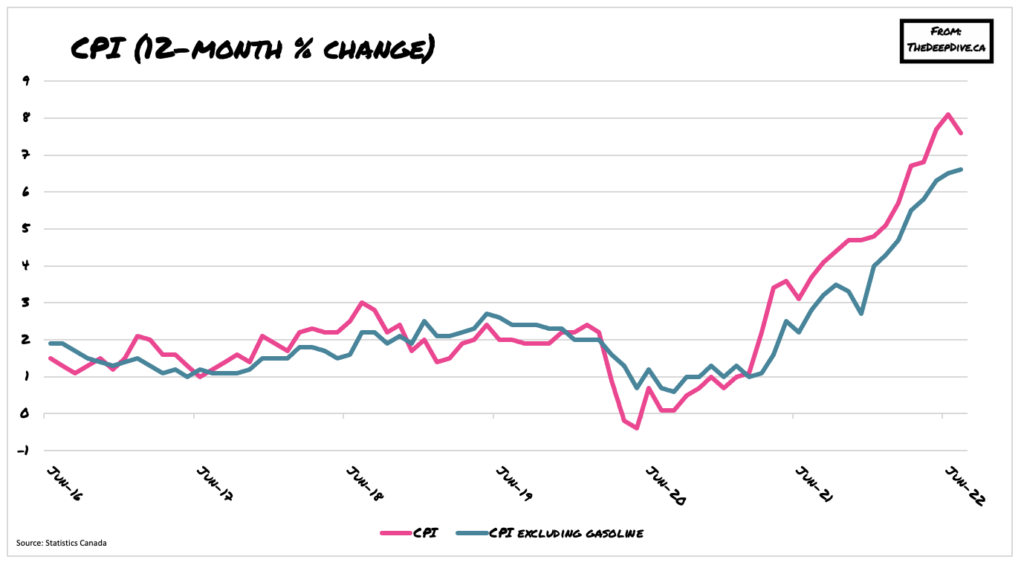

Canadians sighed a breath of relief when they saw last month’s CPI reading, which showed a slowdown in headline inflation from an annualized 8.1% in June to 7.6% in July. In fact, the deceleration in headline CPI suggests that price pressures may have peaked, and puts into question the Bank of Canada’s next move in context of bringing inflation back down to its 2 percent target range.

However, economists are cautioning against too much optimism, given that last month’s softer CPI print was almost entirely due to a decline in gasoline prices, which slumped 9.2% from June. Core CPI, which does not take into account fuel and food prices, stood at 6.6% in July 2021, up from a reading of 6.5% in June. “Fluctuations in the price of gas disproportionately influence consumer perceptions of inflation,” said Conference Board of Canada economist Kiefer Van Mulligen. “Labour strife is rising and wage demands are growing. The summer of our inflationary discontent is not over yet.”

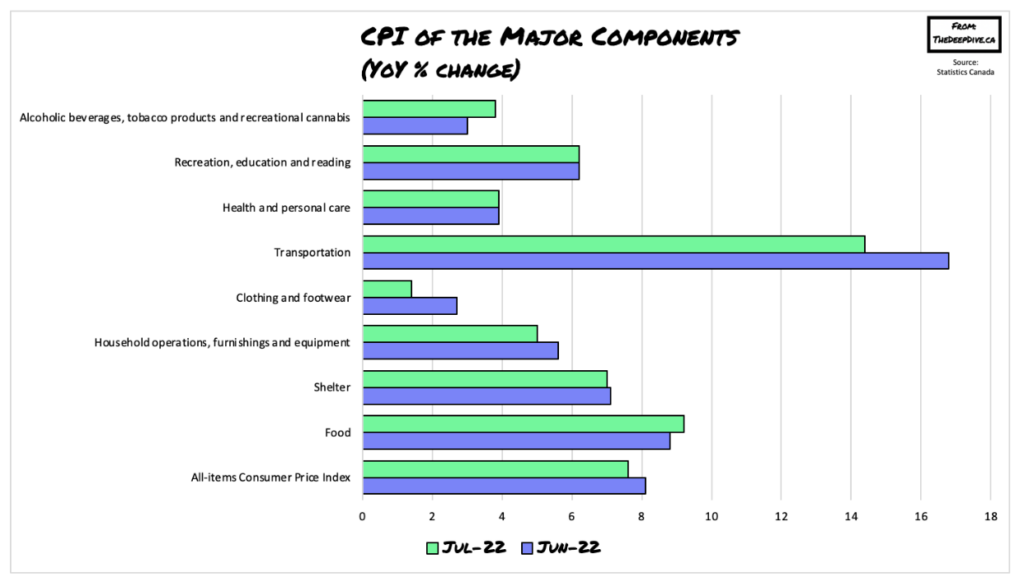

The most important categories affecting the average Canadian consumer— such as food and shelter— continued to increase last month, along with activities related to the lifting of Covid-19 restrictions. “While inflation seems to finally have started its long descent, the acceleration in inflation excluding food and energy will be a concern for the Bank of Canada,” explained CIBC Capital Markets executive director of economics Karyne Charbonneau. “The focus should be on shelter prices (outside of mortgage costs), which should decelerate with the cooling housing market, and overall service inflation.” Given the ongoing rise in core inflation well above the central bank’s target range, Charnonneau predicts another 75 basis point rate hike is in the books come September.

Likewise, RBC economist Claire Fan also believes the Bank of Canada will raise rates 75 basis points at the next meeting, given that there is a long road ahead before inflation falls to the central bank’s target range despite a cooling in commodity prices and a slowdown in the housing market. “It’s not unreasonable to expect the headline CPI rate, together with the breadth of inflation pressure to be turning a corner.” However, “consumer demand will likely need to soften a lot more for CPI growth to fully and sustainably return to the central bank’s one per cent to three per cent target range.”

Desjardins managing director Royce Mendes also cautioned against too much optimism regarding Statistics Canada’s CPI print, since major categories are still undergoing substantial price pressures. “This is no time to get complacent. The 9.2 per cent decline in gasoline prices did a lot to blunt price growth in other areas… Excluding food and energy, prices rose 0.5 per cent in seasonally-adjusted terms in July,” he explained. “The average of the Bank of Canada’s three core measures also jumped up to 5.3 per cent, the highest on record.” Although Mendes does not anticipate policy makers will hike rates by another colossal 1 percentage point, he does believe markets are slated for at least a 50 basis-point increase come September.

Information for this briefing was found via the Financial Post and Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Historically its been proven that once our Economists / Investor types get a chance to gain

prices seldom return to to lower historic norm we need to accept that . Inflation will only stop when they can no longer squeeze any more out of the average Canadian . Interest rates will continue to rise and stay there for a few years as this is profiteering in its easiest form , on the backs of the majority population

Remember Recession is a Govt. creation . Depression is due to a more natural cause