The Bank of Canada signaled it is prepared to unleash a bout of even more aggressive monetary policy action, and potentially hike borrowing costs by as much 75 basis points.

During meetings with the IMF and World Bank in Washington on Thursday, Bank of Canada Governor Tiff Macklem said he was “not going to rule anything out” when it comes to raising interest rates by more than 50 basis points at the central bank’s next policy meeting. He reiterated that Canada’s monetary policy needs to stabilize, and rather quickly. “We’re prepared to be as forceful as needed and I’m really going to let those words speak for themselves,” Macklem said, as cited by Bloomberg.

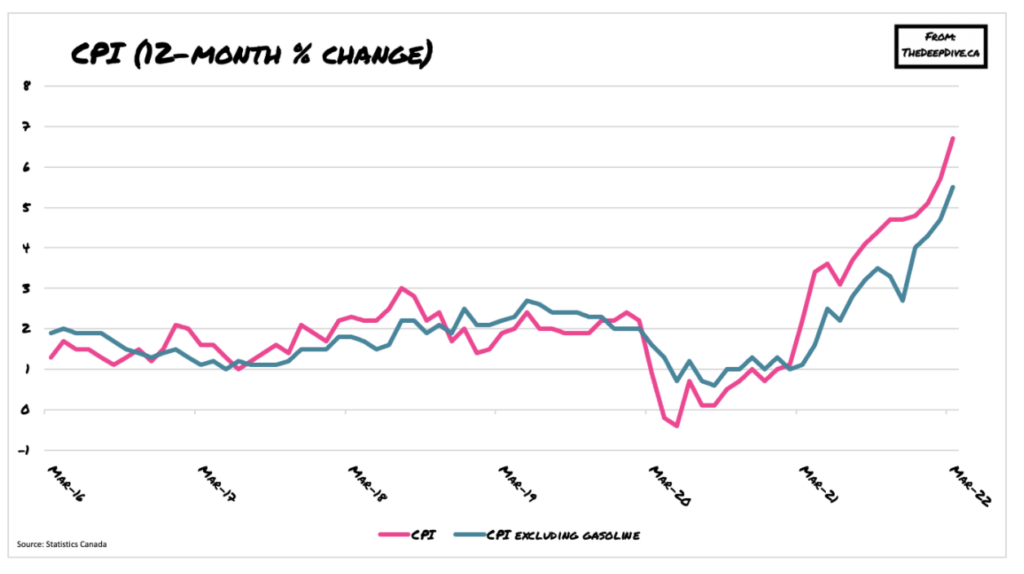

The Governor’s latest comments gave rise to market speculation that the central bank may hike rates by as much as 75 basis points during its next decision on June 1, following a half percentage point increase last week. Such a substantial jump in borrowing costs has not occurred in Canada since the late 1990s. The Bank of Canada’s latest embrace of more hawkish monetary tightening comes on the heels of surging inflation, which hit 6.7% in March.

However, Macklem assured that policy makers are prepared to pause rate hikes should they “begin to bite” and demand starts slumping. “Getting inflation back to our targets is what we need to do to deliver our mandate and ensure that the confidence people have that we will control inflation is in fact realized,” he added.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.