On March 14, Evolution Mining Limited (ASX: EVN) reached an agreement to acquire Battle North Gold Corporation (TSX: BNAU) for $2.65 per share in cash, for a total acquisition price of $343 million. The agreed-upon price represents a 46% premium to Battle North’s close on the previous trading day. The transaction is expected to close in Q2 2021.

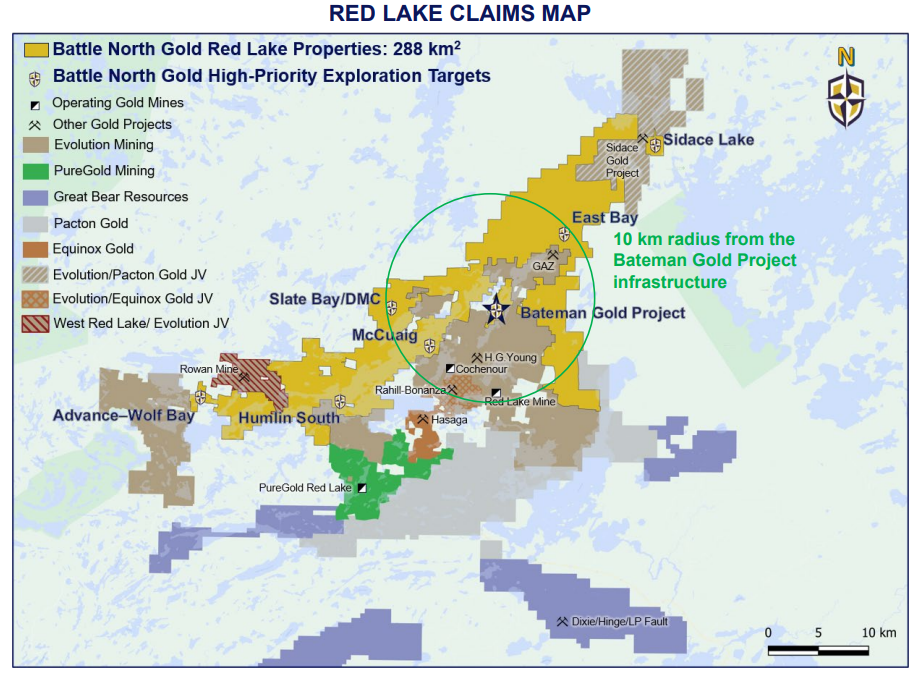

Battle North’s principal asset is the Bateman Gold Project in the Red Lake Gold District in Ontario. In terms of square kilometers, the company controls the second-largest exploration area in the district. Evolution also controls a mine in Red Lake, which is contiguous to Battle North’s property, as well as four mines in Western Australia.

A key read-through from the Evolution-Battle North deal is that Battle North’s takeover price, expressed as a multiple of mineral resources or the estimated net present value (NPV) of the Bateman Project, could suggest that the valuation of Pure Gold Mining Inc. (TSXV: PGM), another leading and well-known player in the Red Lake region, may be full or perhaps ahead of itself. The figure below depicts the claims locations of Battle North, Evolution Mining and Pure Gold within the Red Lake District.

Pure Gold Mining’s high-grade PureGold Mine had its first gold pour in December 2020, with commercial production projected to begin in Q2 2021. Pure Gold plans to achieve first-year production of 59,000 ounces of gold.

The mine has an estimated 2.063 million ounces of gold on an indicated basis (gold grade of 8.9 grams per tonne of resource) and an additional 467,000 ounces on an inferred basis (gold composition of 7.7 g/t), for a total of 2.53 million ounces. A revised Feasibility Study published in July 2019 noted that the PureGold Mine has an after-tax NPV of about $490 million, based on a gold price of about US$1,660 per ounce and a 5% discount rate.

Details on Battle North’s Bateman Gold Project

According to a Mineral Resource Estimate prepared in July 2020, Bateman contains an estimated 979,000 ounces of gold on a measured and indicated basis at a gold grade of 6.63 g/t. Gold contained on an inferred basis is a further 283,000 ounces at a 6.57 g/t gold density, bringing Bateman’s total potential gold ounces to 1.261 million. In a Feasibility Study released in October 2020, it was estimated that Bateman had an after-tax NPV of $435 million based on a US$1,730 gold price and a 5% discount rate.

Comparison of Financial Parameters

Battle Mountain had about $47 million of net cash as of December 31, 2020. Taken together with the $2.65 per share takeover price for its shares, Battle North agreed to be acquired for an enterprise value (EV) price of $296 million. Its takeover EV per ounce of gold resource is about $235, and the ratio of its takeover EV to the NPV of its flagship project is approximately 0.68.

Pure Gold Mining’s stock market capitalization is around $740 million, and it had net debt of about $3 million as of mid-January 2021, bringing its EV to $743 million. Pure Gold’s EV per ounce of gold resource is then about $293 per ounce of gold resource, and the ratio of its EV to the NPV of the PureGold Mine is about 1.52. On both measures, Pure Gold Mining’s valuation is significantly higher than Battle North’s takeover valuation.

| Battle North Gold | Pure Gold Mining | |

| Enterprise Value (EV), in millions of C$ (A) | $296 | $743 |

| Estimated Gold Resources, millions of ounces | 1.261 | 2.533 |

| After-Tax NPV of Flagship Property, in millions of C$ | $435 | $490 |

| EV/Ounces of Gold Resources, in millions of C$/ounce | $235 | $293 |

| EV/NPV of Flagship Property | 0.68 | 1.52 |

Pure Gold Mining’s Financials

As the PureGold Mine neared its first pour, Pure Gold Mining’s operating cash flow deficit reached about $5.5 million in 3Q 2020, up noticeably from the quarterly pace earlier in 2020. The company had about $5 million of net cash on its balance sheet as of September 30, 2020.

| (in thousands of Canadian $, except for shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($4,855) | ($1,393) | ($1,732) | ($3,608) | ($5,681) |

| Operating Cash Flow | ($5,581) | ($402) | ($1,238) | ($1,068) | ($5,222) |

| Mining Capital Expenditures | ($34,279) | ($24,991) | ($10,432) | ($12,383) | ($2,316) |

| Cash – Period End | $56,591 | $89,948 | $62,148 | $70,278 | $85,653 |

| Debt – Period End | $51,848 | $50,173 | $22,744 | $19,585 | $10,614 |

| Shares Outstanding (Millions) | 393.3 | 383.6 | 359.2 | 358.5 | 358.5 |

Investors may focus on Pure Gold Mining’s expected commencement of mine commercial operations in just a few months. At that point, the PureGold Mine would become one of only three commercially operating mines in the Red Lake District. (Newmont Corp.’s giant Red Lake mine and Evolution Mining’s Cochenour Mine are the other two.)

When compared with the contained ounces in its flagship property and the NPV of that property, the current enterprise value of Pure Gold Mining is substantially higher than the takeover enterprise value of a similarly positioned and located junior miner, Battle North. Other factors are important in comparing the two companies, including when the mines will enter service (a factor heavily favoring Pure Gold Mining), but it is possible that the valuation of Pure Gold Mining may have to normalize lower to reflect this disparity.

It should also be noted the price of gold at which the net present valuations were based on. In the case of Pure Gold, it’s current calculation is based on gold being at a price of $1,660 per ounce, while Battle North’s is based on $1,730 per ounce – a difference of $70 per ounce which can quickly add up, and is especially notable given the recent dip in the price of gold below the larger figure.

Pure Gold Mining Inc. is trading at $1.80 on the TSX Venture Exchange and Battle North Gold Corporation is trading at $2.62 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.