Well, it appears that Ryan Cohen has indeed sold out of his position in Bed Bath & Beyond (NASDAQ: BBBY), despite having 90 days after filing his Form 144, which we covered yesterday. Cohen sold his stake in the company through RC Ventures, LLC.

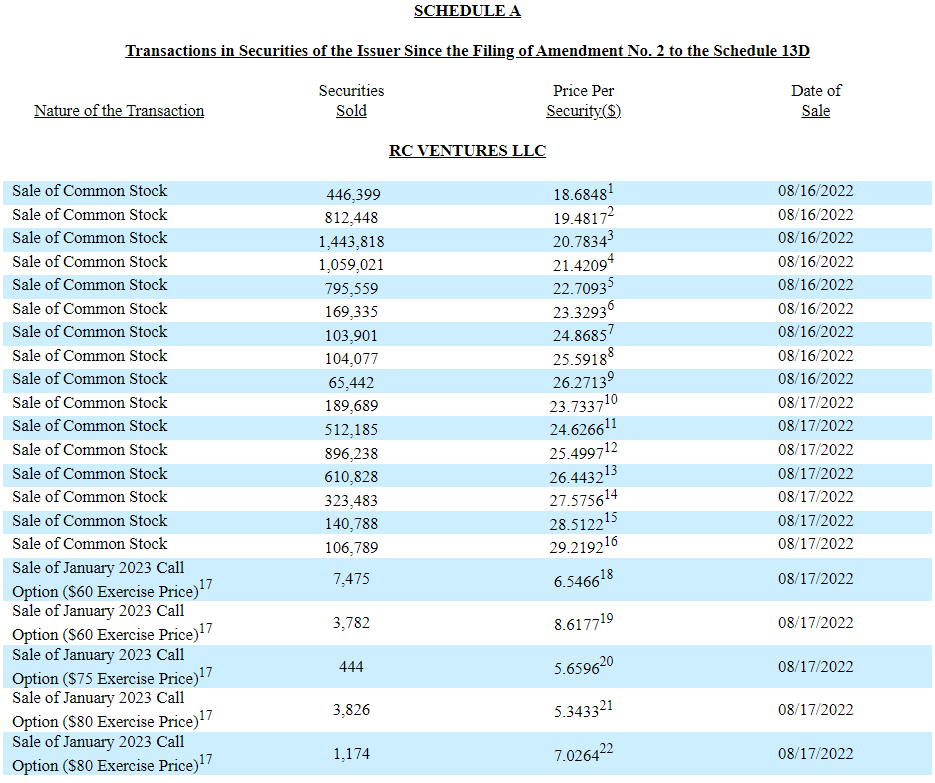

The stake in question amounted to just under 9.5 million shares, which were held via both common shares and call options, both variants of which Cohen has now disposed of. A Schedule 13D filed by Cohen this evening indicated that the common shares were sold at prices between $18.06 and $29.99. The sale of shares collectively amounted to gross proceeds of $178.0 million, based on the data provided.

Combined with call options, total gross proceeds from all transactions are believed to total $189.3 million. Cohen, via RC Ventures, is believed to have made a profit of an estimated $68.1 million from the trades after the price paid for the shares is factored in.

The sales are said to have occurred over August 16 and August 17, with the filing made today on August 18.

Commenting on its relationship with RC Ventures yesterday, Bed Bath & Beyond stated, “We were pleased to have reached a constructive agreement with RC Ventures in March and are committed to maximizing value for all shareholders. We are continuing to execute on our priorities to enhance liquidity, make strategic changes and improve operations to win back customers, and drive cost efficiencies; all to restore our company to its heritage as the best destination for the home, for all stakeholders. Specifically, we have been working expeditiously over the past several weeks with external financial advisors and lenders on strengthening our balance sheet, and the Company will provide more information in an update at the end of this month.”

It appears however that the company no longer needs to put up with the firm or Cohen, given that his 11.8% interest in the company has now been reduced to 0.0%.

Bed Bath & Beyond last traded at $18.55 on the Nasdaq.

Information for this briefing was found via Edgar, Twitter and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.