Earlier this week, Canaccord Genuity sent out an industry update note focused on the U.S. multi-state operators (MSO’s). Bobby Burleson of Canaccord Genuity headlines the note with “U.S. cannabis solidly in growth mode according to BDS data.”

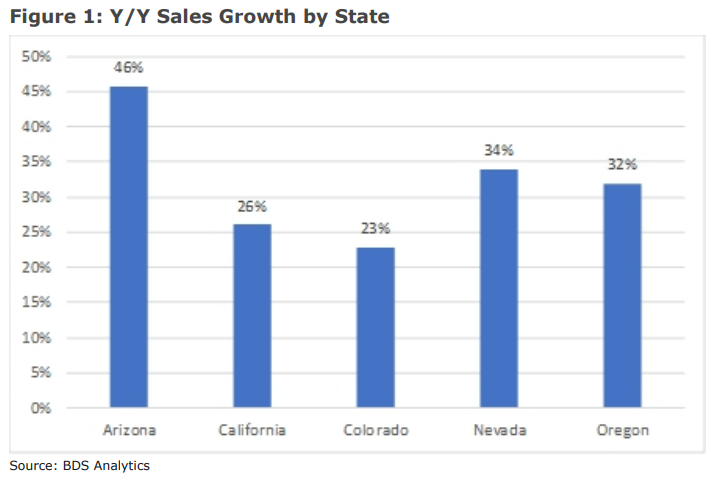

In August, the broad market was up 29% year over year. The leader in this growth is Arizona, which is up 46% year over year. California is up 26% year over year, and Burelson says, “California’s strong growth is contributing disproportionately to broader performance after lagging and hampering broader growth earlier this year and in 2019.” He also makes note that Nevada, which is up 34% year over year, is making a “surprisingly strong recovery despite limited tourism capacity.”

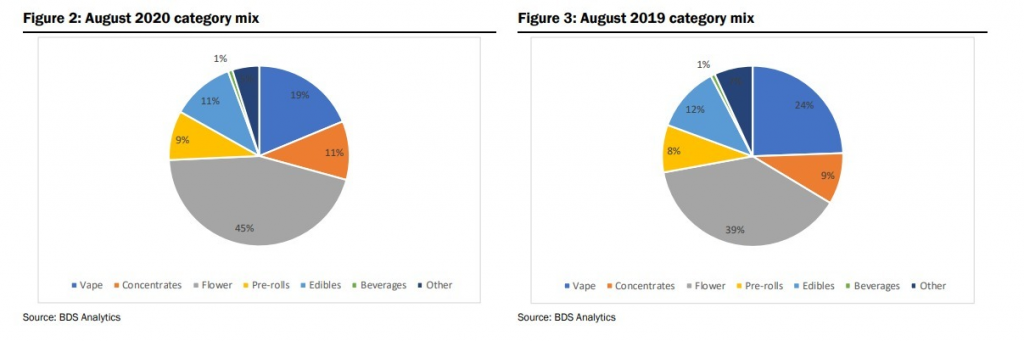

Burelson notes that there is strong flower growth while vape sales lag. Flower sales increased 50% year over year and currently consists of 45% of retail sales now. In comparison, vapes declined 1% year over year and were the only category to do so. Their percentage of retail sales also declined from 24%, now down to 19%.

Onto the specific states that are touched on in this note. First is California, which Burelson comments as having “strong growth trends continue,” as six out of the last seven months California have seen double-digit growth. Once again, flower sales are 42% of retail sales compared to 33% last year, and the only category to feel a decline was vapes, which fell from 30% to 22% over the last year.

Colorado sales increased 24% year over year. Savvy viewer will likely see a trend forming here – flower sales grew in market share from 41% to 45%, and sales increased 37% year over year. At the same time, the vape market share declined from 19% to 15% year over year and was the only category to have declining sales year over year.

Burelson says that Arizona is experiencing the largest growth in sales year over year for 11 months straight. This month Arizona grew 46% year over year. While the product categories pretty much stayed the same, pre-rolls and vapes led the sale growth 89% and 73% year over year, respectively.

Meanwhile in Nevada there has been a “return of growth trends continued in August” as the lack of tourism has hurt the cannabis market. Nevada is still up 34% year over year. Flower sales still dominate the market with 54% of all sales, which is up from 41% in the previous year. As expected, flower sales took market share from vapes, which are down year over year, dropping from 21% down to 16%.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.