Meme stock investing is back in force. On November 2, Bed Bath & Beyond Inc. (NASDAQ: BBBY), a retailer of home, beauty and wellness products, and Avis Budget Group, Inc. (NASDAQ: CAR), a leading car rental company, announced constructive (but not blockbuster) news regarding their businesses. In response, Bed Bath soared 80% in after-hours trading, and Avis more than doubled during regular trading hours.

Bed Bath announced plans to create a vaguely defined digital marketplace to sell its goods, as well as a partnership with Kroger, the largest supermarket chain in the U.S. Avis announced 3Q 2021 revenues that beat analysts’ consensus estimates by about 7%. The company also reported that EPS in the quarter that was about 55% higher than average estimates.

The consistent themes for both Bed Bath and Avis seem to be:

- 1) they are heavily shorted stocks; and

- 2) Reddit investors have decided to become intensely interested in them.

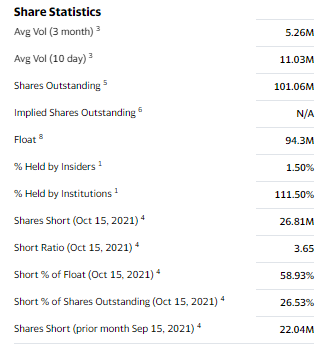

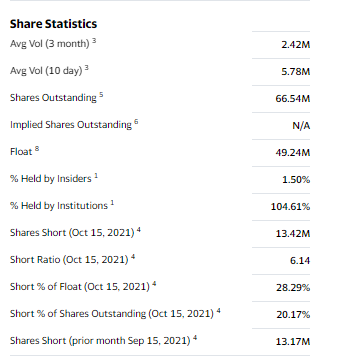

As of October 15, Bed Bath’s short interest was 26.8 million, equivalent to 26.5% of shares outstanding and 59% of the float according to Yahoo Finance. As of the same date, Avis’ short interest was 13.4 million, which represents 20.2% of shares outstanding and 28% of the float.

Comments on the Reddit site discussed MOASS (Mother of All Short Squeezes) considerations for both stocks that portend significant additional share price increases. Most entries conveniently neglect to mention that the November 2 trading volumes of Bed Bath and Avis were 45.9 million shares and 30.5 million shares, respectively. In other words, the single day trading volume of each was about two times its short interest.

In particular, Bed Bath’s sharp price movement seems especially dangerous for fundamental investors. The mere mention of a “digital marketplace” without any real details of what it entails, the timing of the launch, or its potential financial implications, prompted many investors to pay almost any price for the stock.

Investors are providing Bed Bath significant leeway in attempting to reinvent itself and are not requiring many specifics in doing so. This relatively “blind” confidence evokes memories of many new and small investors’ confidence in AMC Entertainment Holdings and GameStop Corp.

Perhaps the key takeaway from the market’s reactions to the news from Bed Bath and Avis is that investors should again steer clear of almost any heavily shorted name on the short side. On the other hand, such a consensus short could be an interesting speculation on any hint of even slightly positive news.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.