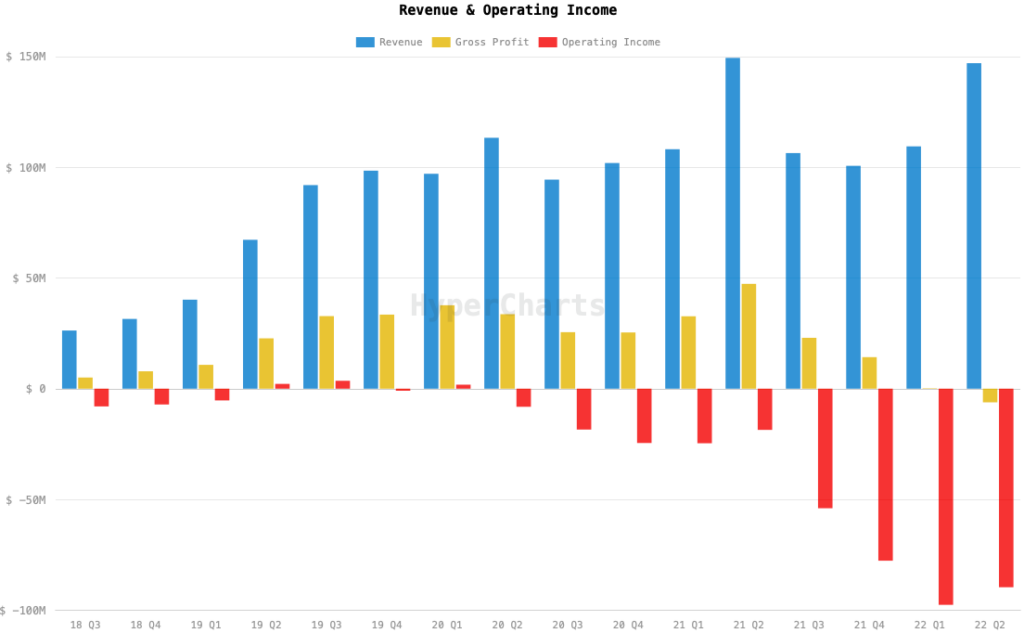

Beyond Meat, Inc. (Nasdaq: BYND) released on late Thursday its Q2 2022 financial results, which saw the company post US$147.0 million in quarterly revenue. This is a marginal decrease from Q2 2021’s revenue of US$149.4 million and also misses the consensus estimate of US$151.0 million.

Breaking down the topline quarterly figure, US operations contributed US$102.3 million, up from last year’s US$101.2 million. International revenue added US$44.8 million, down from last year’s US$48.3 million.

“In Q2 2022, we recorded our second largest quarter ever in terms of net revenues even as consumers traded down among proteins in the context of inflationary pressures, and we made solid sequential progress on reducing operating and manufacturing conversion costs,” commented CEO Ethan Brown.

However, the firm’s shares rallied to as much as 21.19% after the financials were released.

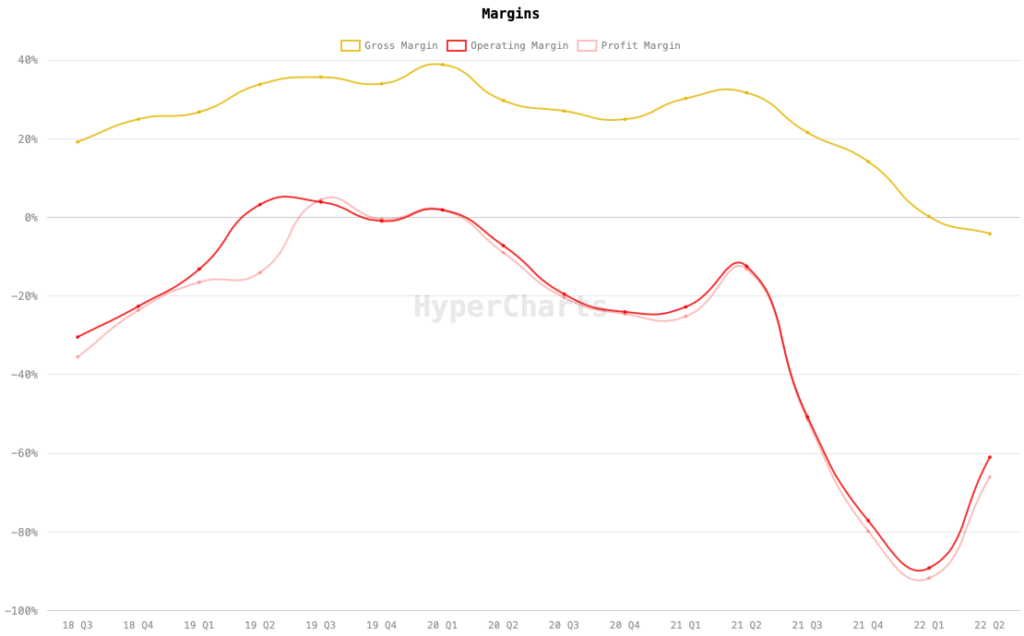

Gross profit was a loss of US$6.2 million, or -4.2% of net revenues, compared to gross profit of US$47.4 million, or 31.7% of net revenues, in the year-ago period. The decline was primarily due to “increased sales of certain inventory to the liquidation channel, as well as higher inventory reserves.”

The year-on-year increase in operating expenses further led to a quarterly operating loss of US$89.7 million compared to last year’s loss of US$18.6 million. This further led the firm to record a net loss of US$97.1 million, a significant decrease from the net loss of US$19.7 million in the year-ago period. This translates to US$1.53 loss per share, also missing the estimate of US$1.18 loss per share.

Further, adjusted EBITDA for the quarter also declined to a loss of US$68.8 million from a loss of US$2.2 million last year. The figure also missed the analysts’ estimate of US$61.0 million loss.

Corollary, the company had an operating cash outflow of US$235.7 million for the year, leading the company to end the year with US$454.7 million in cash and cash equivalents. This brings the balance of the current assets at US$819.5 million while current liabilities ended at US$109.5 million.

For 2022, the firm further tapered down its outlook, estimating US$470 – US$520 million in annual revenue, down from the previously announced US$560 – US$620 million.

In addition, the firm is also planning to cut 4% of its workforce, projecting to save the company around US$8 million annually. The move is presumably part of the company’s focus on “on intensifying OpEx and manufacturing cost reductions.”

“We recognize progress is taking longer than we expected, notwithstanding the increasing urgency and importance of our opportunity. Our transition to mass market consumption will occur as we actualize our vision: providing consumers with plant-based meats that are indistinguishable from, understood as healthier than, and at price parity with their animal protein equivalents,” Brown added.

Beyond Meat last traded at US$31.39 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.