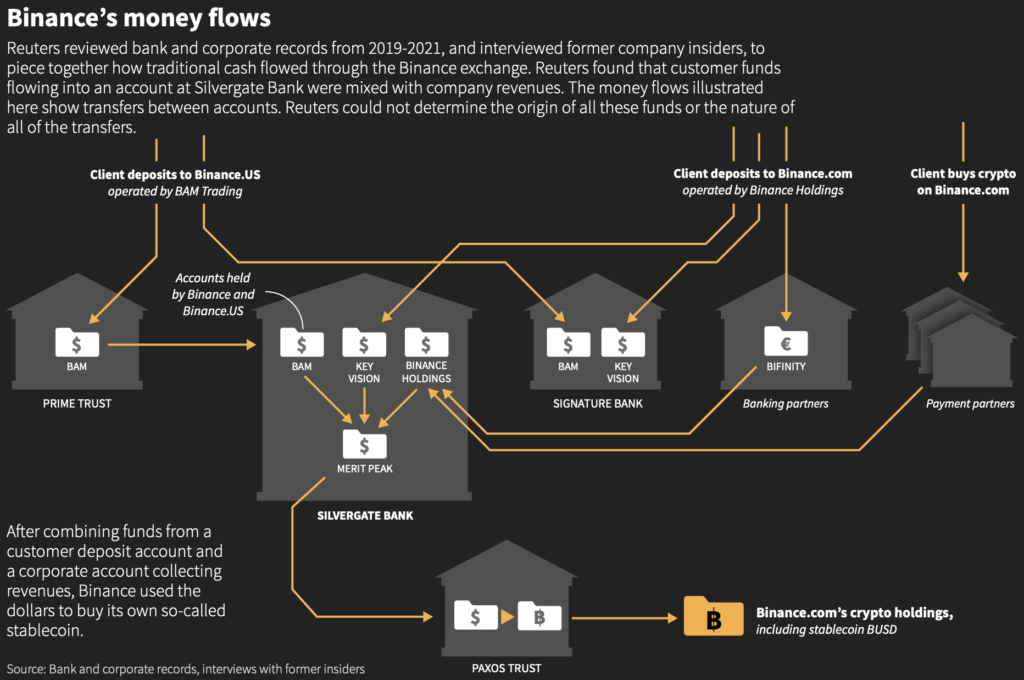

Binance, the world’s largest cryptocurrency exchange, mixed user funds with business revenue in 2020 and 2021, violating US financial rules that require customer assets to be kept separate.

According to sources who told Reuters, the sums ran into billions of dollars and commingling happened almost daily in accounts the exchange held at U.S. lender Silvergate Bank.

While Reuters was unable to independently verify the data or frequency, a bank document obtained by the news agency revealed that on Feb. 10, 2021, Binance mingled $20 million from a business account with $15 million from a client account.

According to three former U.S. regulators, the money transfers at Binance outlined by Reuters show a lack of internal controls to ensure user cash were clearly identified and segregated from company income.

Binance denied mixing client deposits and business funds in a statement to Reuters.

“These accounts were not used to accept user deposits; they were used to facilitate user purchases” of crypto,” said spokesperson Brad Jaffe. “There was no commingling at any time because these are 100% corporate funds.”

He claimed that when users contributed money to the account, they were not depositing monies but rather purchasing the exchange’s proprietary dollar-linked crypto-token, BUSD. This procedure was “exactly the same as buying a product from Amazon,” according to Jaffe.

According to the former US regulators, Binance’s argument was weakened by the exchange’s past claims to clients that the transactions were deposits. Binance’s website informed consumers in late 2020 and into 2021 that their dollar transfers were “deposits” that would be “credited” to their trading accounts in the form of BUSD. Customers were told that they may “withdraw” their deposits in the form of cash. These assurances generated the idea that clients’ monies would be protected in the same way as traditional cash deposits.

Reuters asked Binance if it had ever notified users that their dollar deposits were deemed “purchases.” Binance did not provide evidence of this, saying that “the term ‘deposit’ is a communication term, it’s not an indication of the technical treatment of the funds.”

The issue of commingling funds at Binance started back in December when a piece written by Dirty Bubble Media – whose report on FTX and Alameda was instrumental in exposing the crypto firms – claimed that the exchange is freely exchanging assets with Binance.US in an attempt to skirt American regulatory laws.

The piece cited a Twitter user who has been monitoring the Binance.US transactions since the platform halted withdrawals of the Tether stablecoin (USDT). During this time, the USDT balance in the primary Binance.US wallet fell to its lowest level ever ($197,000).

Recently, it was observed that withdrawals resumed after Binance.US received a single $10 million USDT transfer from an undisclosed address. Those funds were then transferred from two well-known Binance exchange wallets.

Digging deeper, the report disclosed that “since the creation of [Binance.US] wallet in July of 2020, it has moved over $1.4 billion in Ether, USDT, USDC, and MATIC tokens from Binance exchange wallets to Binance.US.”

Binance chief Changpeng Zhao admitted that Binance.US accepts international clients in a Twitter “ask me anything” session following the report.

“The recent [Binance] US to Binance.com international transactions… Binance.US accepts international clients,” said Zhao at the time. “They are market makers that work on both, they transfer funds.”

Silvergate

Bank and company data for 2019-2021 obtained by Reuters, as well as interviews with former insiders, suggest that Binance utilized Silvergate Bank as the lynchpin of its financial operations. Following a bank run, Silvergate is currently in the process of closing down operations.

According to sources and bank records, company income was transferred to the Silvergate account of the exchange’s Cayman Islands parent company, Binance Holdings. Customer funds were transferred to the Silvergate account of Key Vision Development, a Seychelles-based company controlled by Zhao.

One of the sources said Binance told Silvergate that the objective of the Key Vision account was to receive dollar payments from non-US customers. Jaffe stated that this was incorrect, but did not elaborate.

According to the sources and a bank record obtained by Reuters in February 2021, Binance combined customer funds and corporate revenues in a third Silvergate account belonging to a Zhao-controlled Cayman corporation. A source with knowledge of Binance’s group finances and corporate messages said Binance transferred money from this third account into the dollar-linked token BUSD.

Binance purchased at least $18 billion in BUSD from issuer Paxos Trust between January 2020 and December 2021, according to blockchain records.

Concerns related to compliance were raised owing to Binance’s reliance on Silvergate Bank. Samuel Lim, Binance’s former top compliance officer, was accused with assisting the company in breaking US regulations. Guangying Chen was in charge of Binance’s finances, which included numerous bank accounts and transfers.

Evasion operations

Binance was recently reported to have devised a strategy to escape prosecution by regulatory authorities when it established its US entity in 2019, according to the report which cites internal messages and documents from 2018 to 2020 and interviews with former employees.

In a nutshell, the plan was to create a bare-bones American platform, Binance.US, that would license Binance’s technology and name but appear to be completely independent of Binance.com. That would hide the larger Binance.com exchange from investigation by US regulations, which would exclude US users.

In March of this year, the CFTC sued Binance and Zhao for operating an “illegal” exchange and a “sham” compliance program, as well as “willful evasion” of US law, “while engaging in a calculated strategy of regulatory arbitrage to their commercial benefit.”

As regulatory issues continue to hound the crypto exchange, Binance.US and Zhao have reportedly been looking at methods to lower Zhao’s stake in the company. Management has reportedly discussed how lowering Zhao’s ownership could boost the company’s standing with US regulators.

Binance.US officials are concerned that because Zhao is named in the CFTC case, the company may be unable to obtain certain regulatory licenses in the United States as long as he is the majority owner.

Information for this briefing was found via Reuters and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.