In light of this week’s IPO of the highly valued cryptocurrency exchange Coinbase, and the related jump in the Bitcoin price, we explore the market valuation of Bitcoin. The valuation is examined in relation to gold, another widely used inflation hedge, and to the value of publicly traded stocks. Coinbase’s listing is viewed by many as confirmation of the growing mainstream and institutional acceptance of cryptocurrency as a viable investment and means of payment.

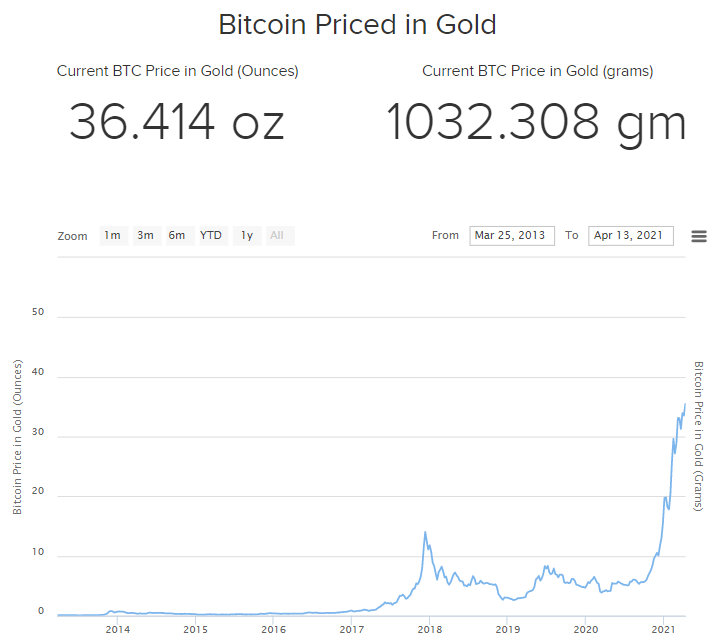

Bitcoin Versus Gold

The graph below depicts the number of ounces of gold required to purchase one Bitcoin over the last eight years. Currently, one must exchange about 36.4 ounces of the precious metal to buy one Bitcoin, approximately triple the amount required at the previous Bitcoin peak in late 2017 and also triple the quantity necessary just three months ago.

Much of the graph’s steepness over the last three months is due to Bitcoin’s rapid ascent over this period, but some also stems from gold’s approximate 15% drop in value from around US$2,035 per ounce in mid-August 2020 to US$1,746 as of late.

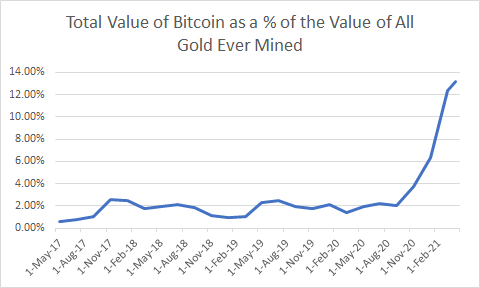

From mid-2017 through the fall of 2020, the total value of all Bitcoin in existence equaled about 2% of the value of gold ever mined (and which is presumably still in existence). Given Bitcoin’s almost exponential move over the last six months, that ratio has jumped to unprecedented levels – currently around 13.2%. (According to onlygold.com, the total amount of gold ever mined is about 5.16 billion ounces.)

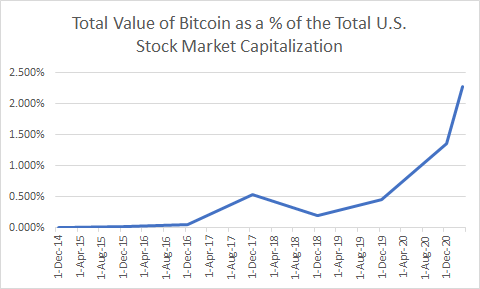

Bitcoin Versus Stocks

The aggregate value of Bitcoin now represents about 2.3% of the value of all publicly traded stocks in the United States. As of March 31, 2021, the value of Bitcoin was about US$1.2 trillion, while the value of U.S. stocks totaled US$49.1 trillion, according to Siblis Research. Like Bitcoin’s value relative to gold, this ratio has moved into uncharted territory. At year-end 2019, Bitcoin’s total value was just around 0.4% of the U.S. stock market capitalization.

Clearly these are unprecedented times, and cryptocurrencies have achieved much wider acceptance among individuals, investors and institutions than they had a year ago. However, the valuation of Bitcoin versus gold or stocks appears to be 3-6 times higher than at times of previous peak relative valuations.

Bitcoin is currently trading at around US$63,088.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.