On March 21, Bitfarms Ltd. (NASDAQ: BITF), one of the world’s leading Bitcoin miners, reported 4Q 2022 results that were down sequentially from 3Q 2022 and from the booming 4Q 2021. Nevertheless, Bitfarms’ 4Q 2022 revenue of US$27 million and its EPS of (US$0.08) were mostly in line with expectations.

Positives from the quarter included Bitfarms’ continuing to rank among the lowest cost Bitcoin miners — its direct costs per Bitcoin mined are about US$11,100 — and the company’s success in slashing its debt level. The company’s total debt was US$65 million at year-end 2022 versus US$96 million at September 30, 2022, and US$124 million as of mid-year 2022.

One of Bitfarms’ most interesting 4Q 2022 disclosures was an adjusted EBITDA of US$1.1 million which compares with US$10.3 million in 3Q 2022. While down ~90% sequentially, we note that Bitfarms’ 4Q 2022 was achieved based on average realized Bitcoin mining prices of about US$18,800 on the 1,434 BTC it mined in the quarter. The larger 3Q 2022 adjusted EBITDA was premised on an average mined Bitcoin price of around US$22,000.

BITFARMS LTD.

| (in thousands of US dollars, except for shares outstanding) | 4Q 2022 | 3Q 2022 | 2Q 2022 | 1Q 2022 | 4Q 2021 |

| Revenue | $27,037 | $33,247 | $41,815 | $40,329 | $59,598 |

| Bitcoin Mined During Quarter | 1,434 | 1,515 | 1,257 | 961 | 1,045 |

| Implied Bitcoin Price Reflected in Revenue | $18,854 | $21,945 | $33,266 | $41,966 | $57,032 |

| Variable Cost Per Bitcoin Mined | $11,100 | $9,600 | $10,100 | $8,700 | $8,000 |

| Operating Income | ($20,021) | ($97,784) | ($173,091) | $6,874 | $15,004 |

| Operating Cash Flow | $33,081 | ($15,728) | $48,129 | ($29,232) | ($6,368) |

| Capital Expenditures | ($36,921) | ($67,808) | ($34,087) | ($67,808) | ($60,820) |

| Adjusted EBITDA | $1,126 | $10,317 | $18,685 | $21,440 | $44,013 |

| Cash – Period End | $30,087 | $35,814 | $45,982 | $77,294 | $125,595 |

| Number of Bitcoin Owned – Period End | 3,301 | 2,312 | 3,144 | 5,243 | 3,301 |

| Debt – Period End | $65,011 | $96,139 | $123,635 | $152,983 | $84,742 |

| Shares Outstanding (millions) | 224.2 | 215.7 | 206.3 | 201.6 | 194.8 |

If one were to recompute Bitfarms’ 4Q 2022 adjusted EBITDA using the current Bitcoin price of around US$28,000, that “adjusted adjusted” quarterly EBITDA would be much more respectable: in the vicinity of US$14 million, or US$56 million annualized.

When compared with Bitfarms’ enterprise value of about US$250 million, such an adjusted EBITDA power figure implies that Bitfarms’ trades at around 5x its cash flow potential based on the more buoyant digital currency market. Investors who are cryptocurrency bulls may consider this 5x figure to be a low multiple of possible future cash flows.

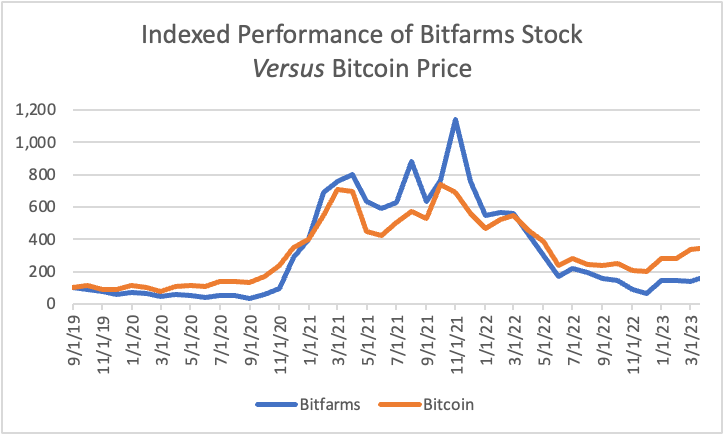

Like most Bitcoin mining stocks, Bitfarms shares have performed quite poorly since mid-August 2022. Over the last seven months, Bitfarms stock is down about 50% even as Bitcoin itself has gained approximately 15%.

Such sharp relative underperformance suggests that Bitfarms could perform better over the next handful of months as the trading relationship between the Bitcoin miner and the underlying digital currency “reverts to the mean.” The figure below shows the indexed performance (100 for both Bitfarms stock and Bitcoin as of August 2019) over the last 4 ½ years. Bitcoin has noticeably outperformed Bitfarms stock for about the last year, but over long stretches in the chart, the opposite relative performance trend has held.

Bitfarms Ltd. last traded at US$0.92 on the NASDAQ.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.