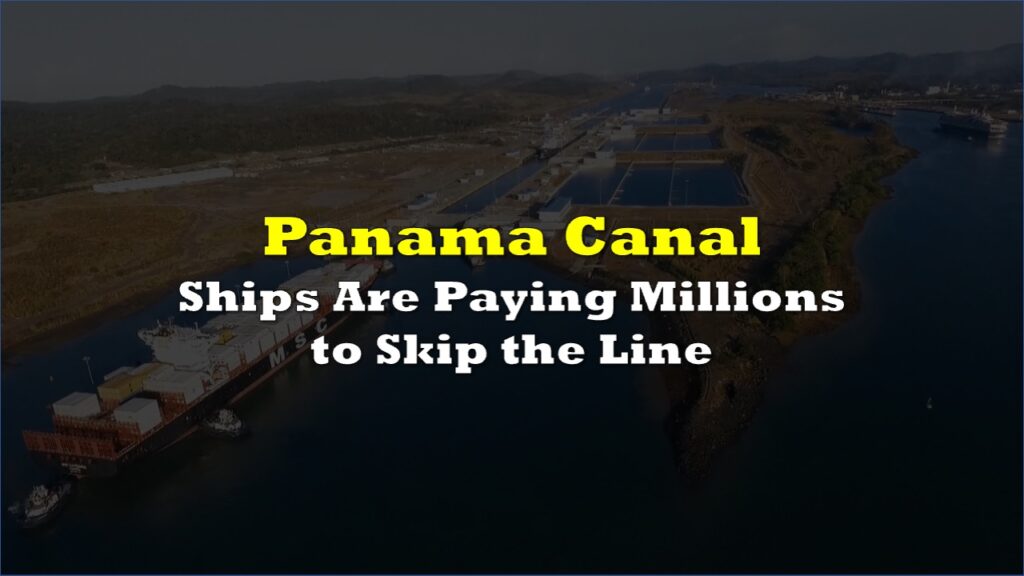

A BlackRock-led consortium has secured a deal to acquire strategic port facilities at both ends of the Panama Canal, officials confirmed Tuesday, establishing American financial control over key infrastructure along the critical maritime passageway.

The $22.8 billion acquisition from Hong Kong-based CK Hutchison comes amid mounting geopolitical tensions over the waterway’s operation.

An investor group backed by BlackRock agreed to buy a majority stake in the Hong Kong-based company that runs ports along either side of the Panama Canal, giving US firm control of key docks https://t.co/DhFwuEdlVw pic.twitter.com/5XnFGIQoqK

— Reuters Business (@ReutersBiz) March 5, 2025

The purchasing consortium, which includes Global Infrastructure Partners and Terminal Investment Limited, will acquire a 90% stake in the company that owns and operates the canal’s Atlantic and Pacific access points.

Market reaction was immediate, with CK Hutchison shares jumping 22% in Hong Kong trading following the announcement. A Financial Times report says the company expects to receive over $19 billion in cash from the transaction.

According to sources familiar with the negotiations, Trump’s election victory in November and his calls for the US to retake control of the canal prompted CK Hutchison to consider the sale after “a short and intense period of negotiations.”

The Panama Canal has become a flashpoint in Trump’s first weeks back in office — with the president claiming, several times, that the canal is under China’s control. BlackRock CEO Larry Fink reportedly briefed senior leaders in the Trump administration, including the president, to secure their backing for the takeover.

Industry analysts note the deal reflects broader shifts in global infrastructure ownership patterns as geopolitical considerations increasingly influence business decisions. The Panama Canal, which handles a significant portion of world maritime trade, has long been viewed as strategically crucial to US interests.

The canal, completed by American engineers in 1914 and transferred to Panamanian control in 1999, has lately become a focal point in US-China tensions, with Trump declaring intentions to strengthen American influence over key global trade routes.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.