Last night, Victor Ferreira of the National Post reported that BMO is no longer allowing investors to short cannabis stocks directly through their self-directed brokerage accounts. The reporter spoke with four investors who all relayed similar experiences.

The reasoning from BMO’s side is due to the risk from volatility. They also mention Tilray is currently carrying a 100 per cent borrow fee as an example of the demand to short stocks in the sector. The Bank of Montreal is a common provider of financing in the space, with recent deals reportedly involving Aurora Cannabis and The Green Organic Dutchman.

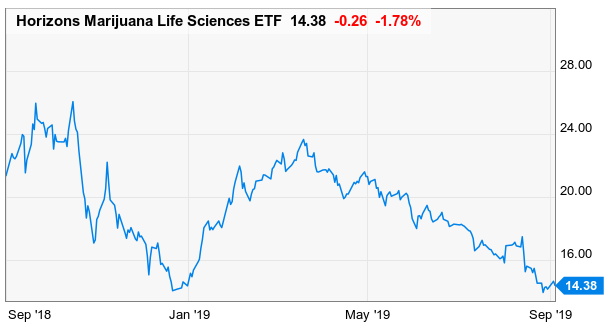

The HMMJ is currently sitting around it’s 52 Week low.

Many thought leaders in the space have argued that this is the time to load up. Peter Warley, a retail investor from Ontario, commented to the Deep Dive last night “Everyone says fall is the time to buy cannabis stocks. And go back to cash by the end of January. I don’t know, it feels like this fall is different.”

It does appear to be a bearish time for the sector with cannabis sales in Canada still trending far short of investor expectations from pre-recreational estimates. And even further proving the bloom may have fallen off the rose, was sector darling Canopy Growth reporting a $1.2B loss last quarter.

Information for this briefing was found via the National Post and Deep Dive Sources. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.