On August 12, Xebec Adsorption Inc. (TSX: XBC) announced its second-quarter financial results. The company announced revenues of $32.7 million, growing 58.4% sequentially. The company had $5 million in gross profit, which grew 19.3% sequentially, and a 15% profit margin. The firm also had a -$6 million operating profit and net income came in at -$7 million. Adjusted EBITDA came in at -$4.6 million.

By the looks of it, almost every analyst lowered their 12-month price target and rating. The 12-month average consensus dropped to $4.86 from $5.51 last month. The company has 14 analysts covering the stock, with 1 having a strong buy rating, 7 have buy ratings and the other 6 have hold ratings. The street high sits at $6.50 from Paradigm Capital while the lowest comes in at $3.25.

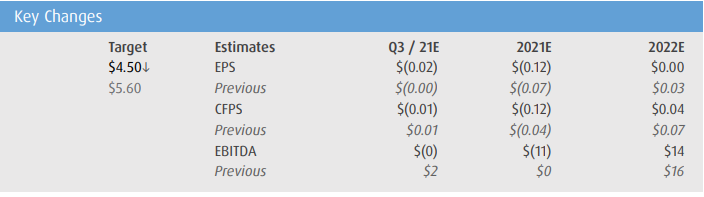

BMO Capital Markets was one of the firms that lowered their 12-month price target, which dropped to $4.50 from $5.60. The firm did however reiterate their outperform rating, saying that they are lowering estimates off lower margins.

The company completely missed BMO’s Adjusted EBITDA estimate of $0.9 million while the consensus was $0.7 million. The miss was mostly attributed to lower gross margins, which BMO calls their “Achilles heel.” They say that Xebec’s legacy RNG systems are continuing to drag the companies results down and because of this, “we are taking a more conservative approach relative to management guidance this year.”

Below you can see BMO’s updated estimates on the company, they say that they have lowered them due to this quarter’s margins as well as management’s own EBITDA guidance dropping from 3-4% to -3% to -4%. Although they believe that the order book remains strong which gives the company a strong upside but the company is now in the “show-me” stage.

Canaccord also lowered their 12-month price target to $5 from $6 and reiterated their buy rating on the stock. Although they echo the same sentiment that BMO does, they believe that the 15% drop represents a buying opportunity.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.