This week, BMO initiated coverage on several large-cap U.S oilfield services. BMO’s Phillip Jungwirth commented on the initiations, stating, “the group is emerging from a multi-year downturn in upstream capital spending and the recent collapse in oil prices. While this is a highly cyclical industry and the stocks are very anticipatory, we expect the road to recovery to take time and for upstream spending to remain low, given our low- to mid-$40Bbl price outlook through 2022.”

Jungwirth says that oil services and producers are now focused on capital discipline, working on making more free cash flow and corporate returns. Alongside a reduced service investment and capacity, cost out and restructuring programs are expected to create margin improvement.

BMO initiated on several names, including:

- Schlumberger (NYSE: SLB), Outperform, $21

- Baker Hughes (NYSE: BKR), Market Perform, $16

- Halliburton (NYSE: HAL), Market Perform, $14

- TechnipFMC (NYSE: FTI), Market Perform, $7.50

- National Oilwell Varco (NYSE: NOV), Underperform, $9

Jungwirth says in the same note that, “the stocks look inexpensive on 2022 estimates assuming upstream spending rises to levels that support modest supply growth, but the outlook is clouded given overarching oil demand uncertainty.” He understands that investors will be more skeptical of the longer-term estimates and apply a higher risk factor and lower multiple.

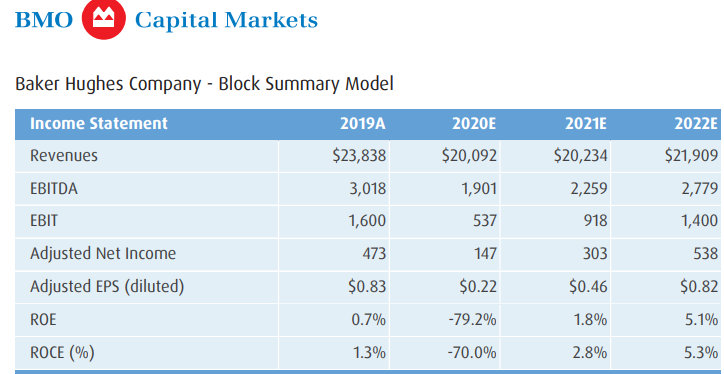

Jungwirth comments that Baker Hughes is their number two pick. The reason they initiated the company with a Market Perform is because of the overall sector performance. The company’s turbo-machinery and process solutions business has given Hughes a reoccurring source and stable income during the downturn. It gives the company a long-term exposure to LNG capacity additions and demand growth. Despite a lack of new LNG investments, backlogs will continue to support strong year-over-year revenue growth for this business’s arm.

Jungwirth says that Hughes oil service and equipment businesses are expected to be 63% of revenue but only 28% of EBIT in 2021. He also notes that it is the only oilfield service company that has not cut its dividend in the downturn and has lower leverage than Halliburton and Schlumberger. He comments, “a lower margin, corporate return, and FCF profile versus SLB is the reason for our Market Perform, but Baker ranks as a close second in our rankings.”

BMO forecasts 2020 and 2021 earnings per share to be $0.22 and $0.46, respectively, increasing to $0.82 in 2022. Jungwirth says that Baker’s 2020 revenue has held up better than Halliburton or Schlumberger and forecasted that revenue would decline 16%. He believes that revenues will rebound in 2021 and be up a modest 1%, then an 8% increase in 2022.

Below you can see the breakdown of BMO’s forecast.

.

Jungwirth has Halliburton as his #1 pick and says he forecasts that the company will have higher EBIT, ROCE, and ROE than Schlumberger but given writedowns in the sector, these metrics have “muddied.” Finally, he states, “we also expect HAL shares to be tied to the North American recovery, which we think could disappoint in terms of where producer activity plateaus to hold oil production flat.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.