IAMGOLD (TSX: IMG) announced yesterday that it has reached an agreement to sell its 95% interest in Rosebel Gold Mines N.V. for $360 million cash and a release of IAMGOLD’s equipment lease liabilities amounting to approximately $41 million.

Management said the deal is expected to close early in the first quarter of 2023. The closing is subject to certain regulatory approvals, including approvals from the relevant authorities in the People’s Republic of China, approval for the transfer of licenses from the Government of Suriname, and other customary closing conditions.

IAMGOLD currently has ten analysts covering the stock with an average 12-month price target of C$2.30, or an upside of 32%. Out of the analysts, one has a strong buy rating, one has a buy rating, four analysts have hold ratings, three have sell ratings, and the last analyst has a strong sell rating on the stock. The street-high price target sits at C$3.50, representing an upside of 100%.

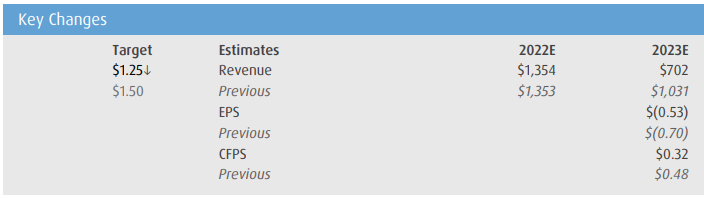

In BMO Capital Markets’ note on the news, they reiterate their market perform rating but lower their 12-month price target to C$1.25 from $1.50, saying that the company is trading future cash flow to narrow the funding gap it is currently facing for its Côté project.

BMO adds that this deal is accretive to their estimates as they previously had the NAV for the Rosebel mines at $210 million, almost half of what the total consideration was for the deal. It is also accretive to the company’s operating costs as they note that this mine was “a very high-cost mine.” As a result, they expect the company’s average unit operating cost to drop meaningfully after the sale.

They add that this helps IAMGOLD bridge the funding gap, which helps de-risk the company and the Côté project. However, they still expect the company to borrow $400 million and defer the $500 million gold prepay, which is due in 2025.

BMO says that it’s all not positive. With the recent prolonged bear market for junior miners, investors continue to look at the company’s underlying cash flow and capital returns as “appropriate de-risking activities.” With the sale of the Rosebel mine, BMO now expects the company’s net twelve-month cash flow from operations per share to be $0.52, down from $0.60.

They write, “We continue to rate IAMGOLD Market Perform as we see risk to the project timeline, budget, and ramp-up.” Below you can see BMO’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.