Yesterday Lundin Mining (TSX: LUN) announced that they had resumed full production at their Chapada Mine. The company said that the day before they finished installing the remaining repaired motor on the ball mill. Lundin says that Chapada is still on track to deliver 2021 guidance.

Lundin Mining currently has 22 analysts covering the company with a weighted 12-month price target of C$11.31. This is up from the average at the start of the month, which was C$10.25. Three analysts have strong buys. The majority, eleven, have buy ratings, and eight analysts, have hold ratings.

In a BMO Capital Markets note, Jackie Przybylowski, their metals, and mining analyst reiterated her C$13 price target and Outperform rating on Lundin. She writes, “Today’s release confirmed the timeline for full restart at Chapada which was consistent with guidance over the past several months and in line with our estimates. Our estimates are unchanged at this time.”

She also notes that the mine has been operating below capacity while the motors were being replaced and that the plant had processing rates at roughly 35% of the nameplate capacity.

Przybylowski then writes that they still expect Chapada to show strong production numbers in 2021 as the downtime during the second half of 2020, “has been used to accelerate maintenance, build run of mine ore stockpile and advance waste removal and development activities.”

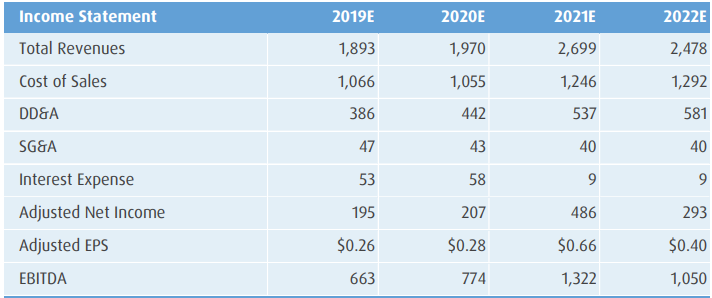

Below you can see BMO’s 2020-2022 full-year estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.