On September 9, Dollarama (TSX: DOL) announced its second quarter 2023 financial results. The company stated that revenues grew 18.2% year over year to $1.217 billion, while EBITDA grew 25.8% to $369.4 million, or a 30.4% margin. Operating income increased 30.3% to $287.4 million, and diluted net earnings increased to $0.66.

The company noted that it opened 19 net new stores during the quarter, higher than the 15 stores it opened during the same time last year. Additionally, the company said comparable store sales grew 13.2% year over year.

For the quarter, Dollarama repurchased 3,690,894 common shares at a weighted average price of $74.48 per share for total consideration of $274.9 million.

Lastly, the company has updated it’s full-year 2023 guidance, updating its comparable store sales growth from a range of 4% – 5% to 6.5% – 7.5%. Dollarama continues to expect to open 60 – 70 net new stores, have gross margins of 42.9% – 43.9%, and SG&A as a percent of sales in the range of 13.8% – 14.3%.

A number of analysts increased their 12-month price targets on the stock, bringing the average 12-month price target to C$86.73 from $79.00 a month ago. There are currently 14 analysts covering the stock, with one having a strong buy rating, eight analysts having buy ratings, and the last five analysts have hold ratings on the stock. The street high price target sits at C$95, or an upside of 20%.

In BMO Capital Markets’ note on the results, they reiterate their outperform rating and $95 12-month price target, noting that Dollarama beat their estimates once again and saying that Dollarama is a “value destination for consumers during this period of high inflation.”

Dollarama’s earnings per share print of $0.66 came in higher than BMO’s estimate of $0.64, while comparable store sales outpaced BMO’s estimate of 11%, which consisted of 20.2% growth but a 5.8% decline in basket size.

Even with inflation, Dollarama saw gross margins increase, albeit at just 0.2% year-over-year growth. BMO believes that the company was positively impacted by a timing tailwind from logistics.

Though they say that the product mix could pressure gross margins “as the proportion of lower margin consumables may continue to grow as consumers seek value for more everyday items at Dollarama.”

Lastly, BMO believes that Dollarama’s stock will continue to be resilient during periods of high inflation due to its “longstanding reputation for compelling value,” and believes that higher inflation levels will continue to drive traffic to their stores.

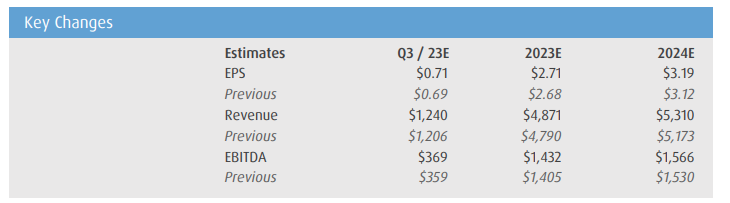

Below you can see BMO’s updated estimates on the stock.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.