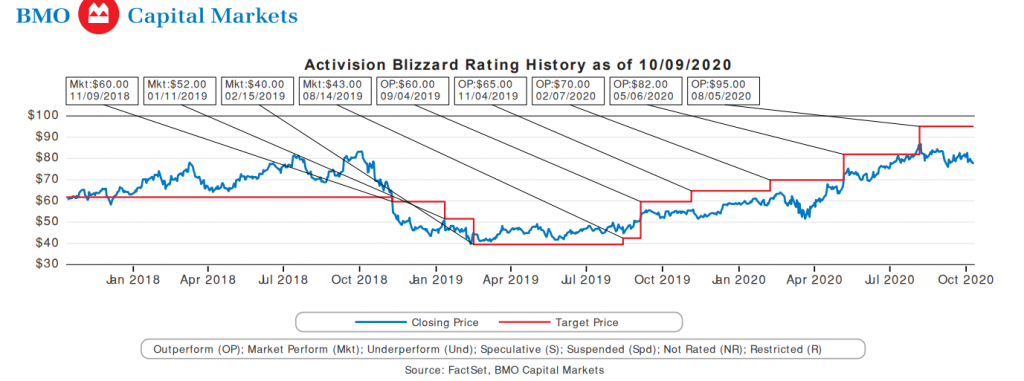

BMO’s analyst Gerrick Johnson is downgrading Activision Blizzard (NASDAQ: ATVI) to Market Perform and reducing their 12-month price target from $95 to $80. He comments on the decision saying, “Our call is to take profits and step to the sidelines after an extraordinary run.”

Since the March lows of ~$52, Activision’s stock has risen more than 50% to ~$80.

Johnson says that they still believe in the longer-term strategy, and while it’s not expensive, they see the current valuation of 22x BMO’s 2022 EPS estimate as fair.

Johnson believes now is the inflection point in the “COVID-19” trade and expects video games multiples to be compressed while investors take profit. In his words, “As the benefits from stay-at-home mandates subside, we expect investors to also reassess the valuation multiples they are willing to assign the shares.”

As we all know, the video game industry received a massive boost from the lockdowns. Activision benefitted both in earnings and multiple expansion, which sounds good, but Johnson believes that inflated earnings expectations because of this boost is a concern as the numbers can be more challenging to achieve. Although he believes that video game engagement will be higher after the pandemic, BMO’s estimates already reflect that.

His second big concern is the hype of the new console cycle might be too much. He says, “We sense little buzz in the industry about the next-gen consoles, and with backwards compatibility and few AAA games released specifically for these systems in 2020, we see little sense of urgency.”

Although this note is not all doom and gloom as Johnson says that the restructuring efforts and overall Activision strategy have “paid dividends.” In the last year, Activision has released World of Warcraft Classic and brought Call of Duty to new platforms. The different modes of play have been an enormous success as CoD and WoW are Activision’s most significant franchises, which equates to about 2/3rds of non-King bookings. Johnson calls Call of Duty Modern Warfare “tremendously successful” but worries that it doesn’t matter how good the next game is. It could end up being a disappointment.

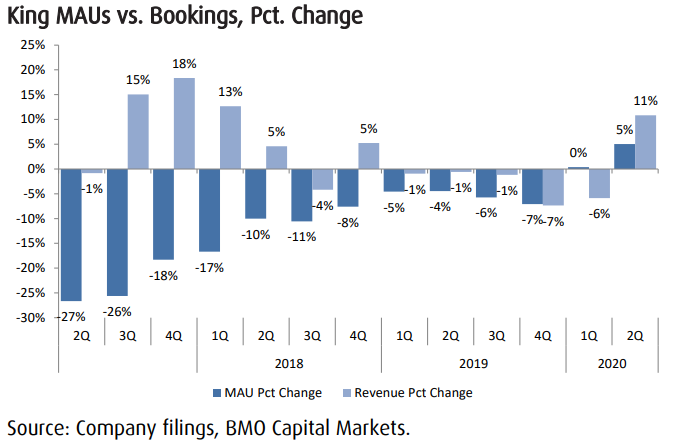

The last thing Johnson hits on is that he believes “investors may be growing tired of King’s underperformance in the mobile game segment,” as King has materially lagged. In 1Q20 and 2Q20, mobile gaming revenue rose by 16% and 28%, but King’s booking were flat and up only 5%, respectively.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.