On Monday Kinross Gold (TSX: K) reported its first quarter financial results. The company saw its revenues come in flat on a year-over-year basis at $768 million, with the company excluding its Russian assets from the year over year comparison due to the previously announced sale. While the company saw its cost of sales grow to $591.4 million from $534 million last year as the company gets hit by inflation.

This brought the company’s gross profits lower, coming in at $176.6 million, while its earnings from continuing operations came in at $77 million, down from $131 million a year ago. Though the company saw its total net income go negative, to ($523.9) million. This is due to the company reporting a loss of $606.1 million in its discontinued Russian assets as a result of impairments on the low sale price.

On the production results, Kinross said it produced 413,350 gold equivalent ounces from its continuing operations, which excludes 95,891 ounces from their Kupol mine. Additionally, the company said it sold 409,538 gold equivalent ounces this quarter, which excludes an additional 85,937 sold from the Kupol mine. They noted that the average realized gold price per ounce from continuing operations was $1,875, compared to $1,787 from the same time last year. While the all-in sustaining cost per ounce from continuing operations was $1,000, which is up from $798 a year ago.

Lastly, the company provided pro-forma guidance for the year. The company said it expects to produce 2.15 million ounces in 2022, 2.3 million in 2023, while it expects to produce 2.1 million ounces of gold in 2024 and 2.0 million per year through to 2029. They also maintained their production costs of $830 per ounce and an all-in sustaining cost of $1,150 per ounce.

Kinross Gold currently has 12 analysts covering the stock with an average 12-month price target of C$10.60, or an upside of 80%. Out of the 12 analysts, 3 have strong buy ratings, 6 have buy ratings, and the last 3 analysts have hold ratings. The street high sits at C$14, which represents a 140% upside to the current stock price.

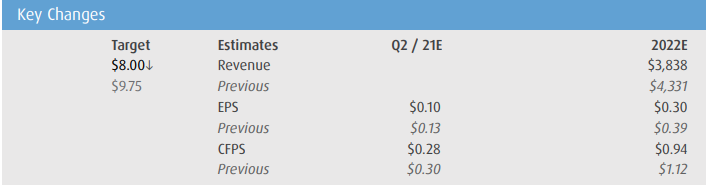

In BMO Capital Markets’ note on the results, they reiterate their outperform rating but lower their 12-month price target from C$9.25 to C$8.00, saying that the sale of Russian assets that happened during the quarter created a messy looking result. They say, “Kinross’ reported results excluded the Chirano and Kupol mines, which made a miss on production and sales appear more significant.”

On the results, BMO says that they were expecting 539,000 ounces to be produced this quarter versus the 505,700 actually produced from the company’s discontinued and continuing operations. They say that excluding the Chirano and Kupol production, lower production at Round Mountain, and Paracute were the contributors to the company missing the estimate.

On the guidance revisions, BMO says that this was telegraphed as the guidance now reflects the assets that have been sold. Though BMO says that they expect “significant positive catalysts” to be achieved and are upcoming for the stock. They say that the biggest catalyst is the Tasiast mine consistently reaching 21ktpd throughput level on schedule. While the other “important near-term” catalysts include the Round Mountain optimization study to be completed in the second half of 2022 and the starting of a pre-feasibility study on Dixie in 2023.

Below you can see BMO’s updated estimates on the stock.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.