Kinross Gold (TSX: K) is finally selling off its Russian assets. After announcing last week its intent to sell the assets and that it was receiving several unsolicited offers, the company has now evidently agreed to sell the properties a Russia-based gold producer.

The company will be selling the assets to the Highland Gold Mining group of companies, whom is one of the largest gold mining firms in the country. The company currently has operating mines in the two regions where Kinross’ Kupol mine and Udinsk project are found.

Consideration for the properties consist of $680 million, payable in cash. However, cash will be paid out over a series of several years. For the Kupol Mine, the company will receive $400 million, of which $100 million is to be paid upon closing, while $150 million is to be paid by the end of next year, $100 million before the end of 2024, and a final $50 million by the end of 2025.

Udinsk meanwhile will receive $280 million in consideration, consisting of $80 million by the end of 2025, $100 million before the end of 2026, and $100 million before the end of 2027 – meaning the company won’t even begin to see a penny of proceeds for the Udinsk project until 2025 at a minimum.

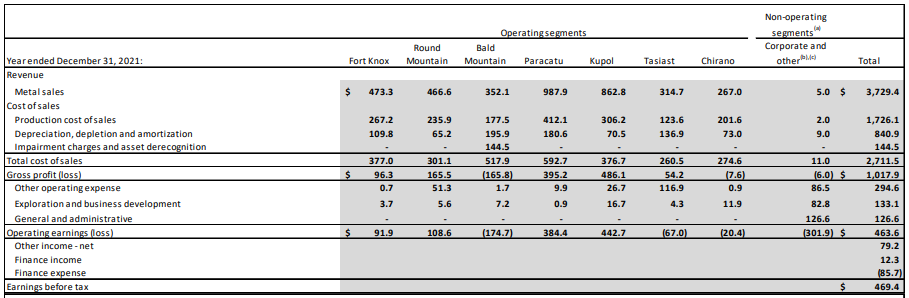

To say that the sales figures are a kick in the teeth to Kinross is simply an understatement. For the year end December 31, 2021, the Kupol Mine represented $862.8 million in sales for Kinross, or 23.1% of all revenue generated for the year. In fact, Kinross didn’t even achieve a sales figure of 1x gross profit at the mine, with the mining seeing gross profits of $486.1 million last year – and that multiple doesn’t yet factor in the actual time frame in which the company will receive the consideration.

In terms of operating earnings though, the mine generated $442.7 million in positive earnings, compared to total operating earnings of $463.3 million. To say that the mine accounted for 95.5% of positive operating earnings wouldn’t be fair to the Paracatu Mine which generated $384.4 million in positive operating earnings in the same time period, however, it would seem fair to indicated that total operating earnings once corporate and other segments are factored in are in significant trouble with the loss of Kupol.

While a major loss to the company, at this point it wasn’t unexpected. BMO Capital Markets by the midpoint of March had estimated the firm would be selling off the assets, and as a result lowered their price target from $11.00 to $10.50. Canaccord Genuity meanwhile lowered their price target to $9.50 on the expectation of the asset sale nearly a full month ago.

Kinross Gold last traded at $7.50 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.